Bitcoin Transactions Surge to 21 Month High – What This Means For BTC Price

The number of transactions recorded on the Bitcoin blockchain jumped to nearly 300,000 on Saturday the 14 of January, its highest level since April 2021, according to data from crypto analytics firm Glassnode. Just a few weeks ago, daily transactions had been as low as 240,000.

The uptick in activity on the Bitcoin blockchain coincides with a recent surge in the price of the world’s largest cryptocurrency by market capitalization. BTC/USD was last changing hands in the $21,100s, according to Trading View citing Coinbase exchange data. That means the cryptocurrency is currently trading higher by about 28% this month.

Traders have attributed Bitcoin and the broader cryptocurrency market’s gains to macro tailwinds, including an easing of US inflation concerns after the latest CPI and jobs reports and fresh evidence of a slowing US economy, the combined effect of is encouraging traders to dial down on Fed tightening bets for this year and next.

Bitcoin and cryptocurrencies tend to perform when financial conditions ease and, as a result of macro tailwinds, alternative.me’s Bitcoin fear & greed index has moved sustainably out of fear (i.e. above 50) for the first time since last April.

Bitcoin’s latest surge resulted in a wave of short position liquidations, which peaked at $141 million in one day last Friday according to data from coinglass.com, the highest in at least three months.

The latest rally also resulted in a modest uptick in Bitcoin funding rates across major cryptocurrency exchanges, according to coinglass.com. According to coinglass.com, “positive funding rates suggests speculators are bullish and long traders pay funding to short traders”. But the small jump in BTC funding rates was small compared to the massive drop in funding rates seen in the immediate aftermath of the collapse of FTX in early November.

What Does Surging Transactions Mean for Bitcoin’s Price?

Some cryptocurrency bulls will hope that the recent surge in transactions on the Bitcoin blockchain might reflect an increase in demand for the tokens, and that this increase in demand could help lift prices in the coming weeks and months. However, other on-chain metrics are not supportive of this thesis.

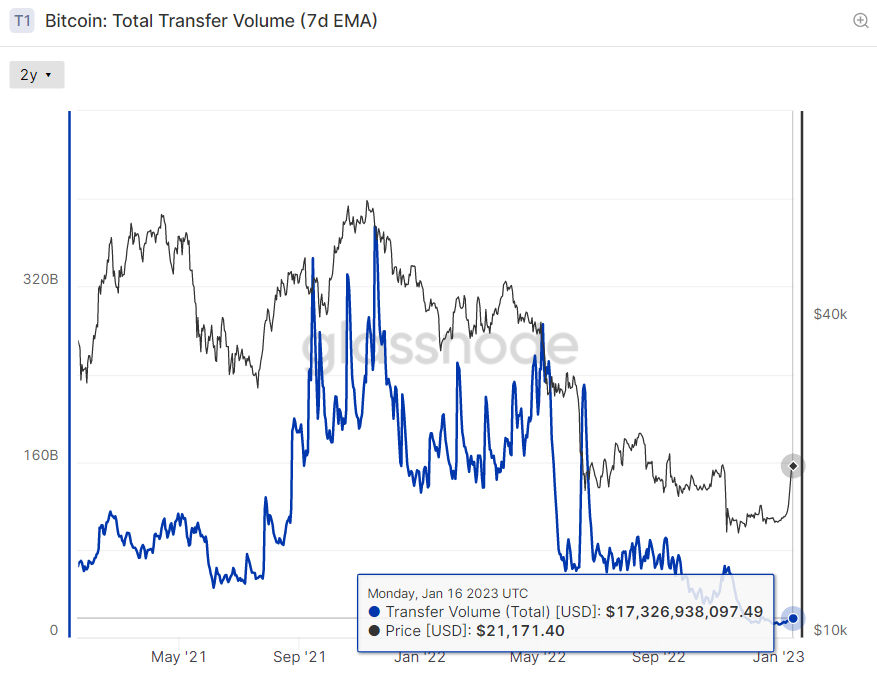

According to Glassnode data, the total value of Bitcoin transferred across the blockchain remains close to multi-year lows, despite the spike in transaction numbers. On Monday the 16th of January, transfer volume was just over $17.3 billion, still well below its pre-FTX collapse levels.

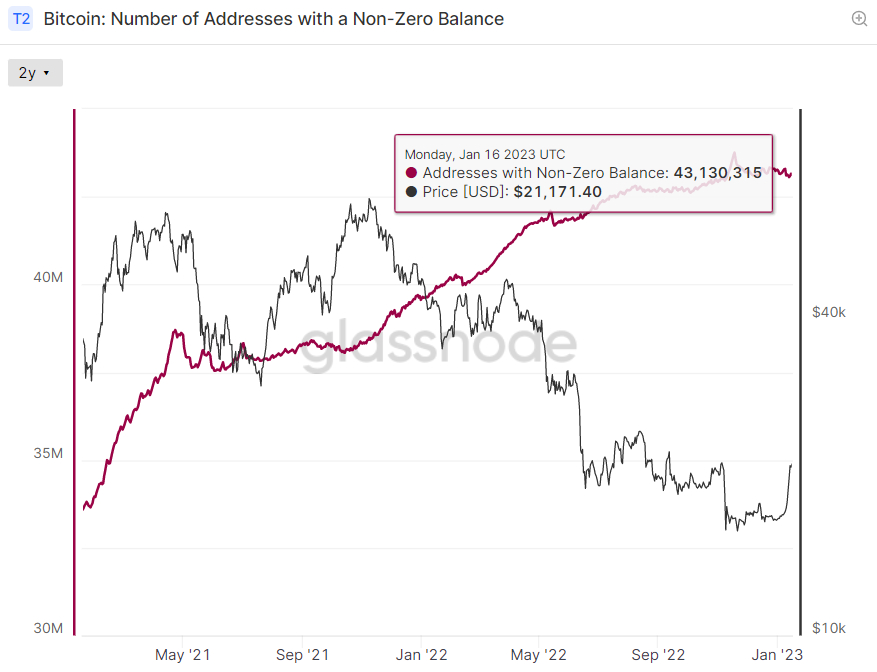

While more individual transactions might be occurring, more value is not being transferred across the network, this data shows. Meanwhile, the number of addresses holding a non-zero balance of Bitcoin has remained broadly unchanged in recent weeks at just over 43.13 million, after tumbling in wake of the FTX collapse just over two months ago.

That suggests that the recent transaction surge is not being driven by the accumulation of Bitcoin by new buyers. So does all of this suggest that the latest Bitcoin rally is overdone?

Not necessarily, but it does suggest that the on-chain data isn’t yet signaling an imminent continuation of the bull market. Indeed, technicians have noted that Bitcoin’s failure this week to reconquer key resistance at $21,500 combined with very overbought short-term market conditions, as per the 14-Day Relative Strength Index (RSI), raises the risk of a short-term profit-taking driven pullback under the $20,000 level.

In the case of a dip back under $20,000, analysts would be watching closely how Bitcoin responds to a retest of its 200-Day Moving Average at $19,500 and Realized Price at $19,700. If Bitcoin can hold above both of these key levels, analysts think this could be a sign that the bear market of 2022 might be over.