Why This Is Bullish For Bitcoin

On-chain data shows the stablecoin market cap has returned to positive growth recently, which can be bullish for Bitcoin.

Stablecoin Market Cap Has Finally Flipped On 30-Day Change

As explained by CryptoQuant founder and CEO Ki Young Ju in a new post on X, the stablecoin market cap has set a new all-time high (ATH) following the renewal of the uptrend.

Below is the chart shared by Young Ju that shows the trend in the 30-day percentage change for the market cap of the biggest stablecoin in the sector, Tether (USDT), over the past year:

Looks like the value of the metric has just flipped into the positive territory | Source: @ki_young_ju on X

As is visible in the above graph, the 30-day percentage change in the market cap of USDT had turned negative earlier, implying that the total valuation of the stablecoin had been shrinking.

The decline didn’t last for too long, though, as the metric has recently flipped back into the positive region. The surge above zero is only slight, meaning the potential turnaround has just started.

Historically, a rise in the market cap of stablecoins has been a bullish sign for Bitcoin. In the chart, the analyst highlighted how this pattern followed during the past year.

To understand why the stables relate to Bitcoin, their role in the market must first be examined. Generally, investors store their capital in these fiat-tied tokens to avoid the volatility associated with other cryptocurrencies.

However, holders who keep their capital like this usually plan to dip back into the volatile side. As such, the market cap of the stablecoins can, in a way, represent the available buying power for coins like Bitcoin. Therefore, when this metric rises, so does the dry powder available for BTC and others.

The latest reversal in the Tether market cap has come as BTC itself has shown a sharp recovery surge, suggesting that the increase in the stablecoins has come due to fresh capital inflows rather than a rotation of capital from the number one cryptocurrency.

This may be an especially bullish combo, as it suggests that not only is their capital sitting on the sidelines waiting to be deployed into Bitcoin, but BTC itself has also seen direct capital inflows.

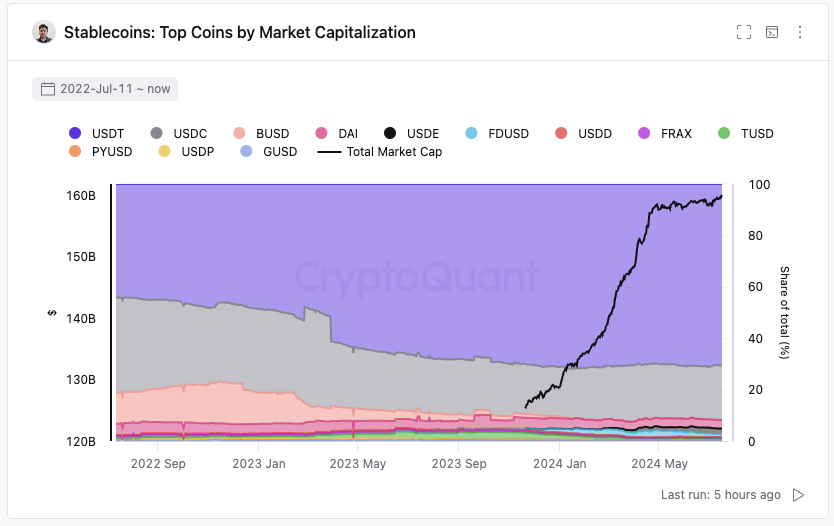

Following the latest increase, Tether now occupies around 70% of the total stablecoin market cap, as the chart below displays.

The share of the total stablecoin market cap occupied by the various tokens | Source: @ki_young_ju on X

As is also apparent from the graph, the total stablecoin market cap has set a new record following the return of capital inflows.

Bitcoin Price

At the time of writing, Bitcoin is trading at around $63,700, up more than 10% over the past week.

The price of the coin appears to have been rising in recent days | Source: BTCUSD on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com