Why Are NFTs Bad? The Problem And Legal Issues

Why Are NFTs Bad? This pressing question underscores today’s heated discussions around Non-Fungible Tokens (NFTs). Despite the buzz, many investors are left grappling with unsellable NFTs, questioning their value and security. This article cuts through the noise to examine the critical issues and legal challenges surrounding NFTs.

We navigate the complex NFT laws, dissect the reasons behind the unsellable nature of some digital assets, and address the underlying problems fueling the skepticism. With focused insights, we aim to shed light on the darker aspects of NFTs to answer the question: are NFTs bad?

Why Are NFTs Bad?

The question “Why are NFTs bad?” resonates in the digital world, particularly among those cautious about the rapidly evolving blockchain technology. NFTs, or Non-Fungible Tokens, have garnered attention for their unique ability to represent ownership of digital assets. However, beneath the surface of this innovative technology lies a web of concerns that have led many to question their overall value and impact.

Understanding NFTs: A Brief Overview

NFTs are digital tokens that represent ownership of unique items, using blockchain technology to certify authenticity and ownership. Each NFT stands out as distinct, unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible and allow for one-to-one exchanges. They can represent anything digital, such as art, music, or even tweets.

NFTs derive their uniqueness from granting a feeling of exclusivity and ownership over digital assets, which have traditionally been easily replicated and distributed. By tokenizing these assets on a blockchain, NFTs create a digital scarcity and a verifiable way to claim ownership.

However, the rise of NFTs has not been without controversy. Their detractors point to several key issues: technical issues questioning the longevity of NFTs, the potential for market manipulation, and the creation of a speculative bubble where the value of digital assets is highly uncertain. Furthermore, the legal landscape surrounding NFTs is still evolving, with questions about copyright and ownership rights at the forefront.

Exploring The Main Question: Why Are NFTs Bad?

While NFTs have their benefits, the growing concerns cannot be overlooked. The main question, “Why are NFTs bad?” stems from several critical issues associated with their use and functionality.

Technical Challenges And Longevity Concerns

The appeal of NFTs on blockchains such as Ethereum is diminished by various technical challenges, raising questions about their long-term viability and dependability as digital assets. Here are some technical reasons for “why are NFTs bad”:

- Off-Blockchain Asset Storage: Most NFTs, especially on Ethereum, link to digital assets like images stored off the blockchain due to Ethereum’s size and cost constraints. These assets are often hosted on platforms like IPFS (InterPlanetary File System), not directly on the blockchain.

- External URL Vulnerability: The use of external storage like IPFS raises questions about the longevity and accessibility of the linked digital assets. The potential obsolescence of these platforms poses a risk to the permanence of NFTs.

- Blockchain-Specific Uniqueness: The uniqueness of an NFT is limited to its native blockchain, like Ethereum. The same asset can be tokenized on different blockchains, challenging the notion of uniqueness.

- Duplicate NFT References: NFTs can reference the same digital asset via HTTP links, leading to multiple NFTs for a single asset within the same blockchain, contrary to their non-fungible nature.

Market Manipulation And Speculative Bubble

The NFT market is not just a platform for digital creativity but also a hotbed for speculation and potential market manipulation, raising significant concerns. Following are some market-related reasons for “why are NFTs bad”:

- Speculative Investments: NFTs have become symbols of speculative investment, with prices often driven by hype rather than intrinsic value. High-profile sales, like that of Beeple’s artwork, have attracted a wave of investors looking to capitalize on potential market booms. This speculation can inflate prices artificially, creating a bubble where the value of NFTs is grossly overestimated.

- Risk Of Market Manipulation: The NFT marketplace is vulnerable to manipulation due to its relatively unregulated nature and the opacity of transactions. There have been instances where artists or sellers artificially inflate the value of an NFT by purchasing their own assets through third parties. This tactic creates a false impression of high demand and value, luring unsuspecting buyers into overpaying.

- Impact Of Celebrity Endorsements: The involvement of celebrities and influencers in promoting NFTs further fuels the speculative bubble. Their endorsements can lead to rapid spikes in prices and interest, often without a sustainable basis. While celebrity involvement has brought mainstream attention to NFTs, it also raises questions about the genuine value and long-term viability of these assets.

- Volatility And Unsustainability: High volatility marks the NFT market, featuring significant fluctuations in value. This instability renders NFT investments risky, especially for individuals not deeply familiar with the digital asset landscape.

Legal Ambiguity

The burgeoning world of NFTs is mired in legal ambiguities, making it a complex landscape to navigate for creators, collectors, and investors alike. Below are some legal reasons for “why are NFTs bad”:

Unclear Copyright And Ownership Rights:

One of the fundamental legal challenges with NFTs is the ambiguity surrounding copyright and ownership rights. Purchasing an NFT often grants the buyer ownership of a unique token, but not necessarily the copyright of the underlying digital asset. This distinction can lead to confusion and disputes over what buyers are actually entitled to when they acquire an NFT.

Varying International Laws:

The legal recognition of NFTs varies significantly across different jurisdictions. While some countries may have specific regulations governing digital assets, others lack clear guidelines. This inconsistency presents challenges, particularly in cases involving cross-border transactions or disputes.

Smart Contract Complexities:

NFTs operate on smart contracts—self-executing contracts with the terms of the agreement directly written into code. However, the legal status of these contracts is not always clear. Issues arise when smart contracts, which are immutable once deployed, contain errors or do not align with legal standards. Rectifying these issues can be complicated and may require litigation.

Regulatory Uncertainty:

The regulatory landscape for NFTs is still in its infancy. Financial regulators in various countries are grappling with how to classify NFTs—whether as securities, commodities, or a completely new asset class. This lack of regulatory clarity adds to the uncertainty, particularly regarding compliance with existing financial laws and anti-money laundering (AML) requirements.

Liability And Consumer Protection:

The decentralized nature of NFT marketplaces often leaves consumers with limited recourse in cases of fraud, theft, or disputes. In such scenarios, the issue of liability remains mostly unresolved, and consumer protection mechanisms are not as strong as those in traditional financial markets.

NFT Pros And Cons

The world of Non-Fungible Tokens (NFTs) presents a mixed bag of advantages and drawbacks. Understanding these pros and cons is essential for anyone looking to engage with NFTs, whether as creators, collectors, or investors.

Pros Of NFTs:

- Digital Ownership And Provenance: NFTs provide a clear proof of ownership and provenance for digital assets. They enable artists and creators to monetize digital works, which were previously easy to replicate and difficult to sell as unique pieces.

- Market Expansion For Artists: NFTs have opened up new markets for digital artists and creators, allowing them to reach a global audience. This democratization of art sales has empowered artists, especially those outside the traditional gallery system.

- Innovation And Creativity: The NFT space encourages innovation and creativity, particularly in digital art and multimedia. It has sparked new forms of artistic expression and collaboration.

- Collectibility And Investment: For collectors, NFTs offer a new avenue for investment in digital art and collectibles. The unique nature of NFTs makes them appealing as collectible items.

Cons Of NFTs:

- Technical Issues: On blockchains like Ethereum, NFTs present several technical issues, questioning their longevity. Being aware of these issues is crucial.

- Market Volatility And Speculation: The NFT market is highly volatile, with values fluctuating dramatically. This instability, coupled with speculative investments, poses risks for buyers and sellers.

- Intellectual Property Issues: The legal ambiguity around copyright and ownership rights in NFTs creates complications for intellectual property law. Buyers might not fully understand what rights they are acquiring, leading to potential legal disputes.

- Accessibility And Inclusivity Issues: Despite their potential for democratizing art, NFTs also pose challenges in terms of accessibility and inclusivity. The technical and financial barriers to entry can be high, limiting participation to a more tech-savvy and financially capable audience.

The Dark Side: Unsellable NFTs And Market Risks

The world of NFTs is not just about innovation and lucrative opportunities. There’s a darker side to this market, characterized by the phenomenon of unsellable NFTs and significant market risks that raise critical questions about the overall safety and soundness of investing in these digital assets. This adds another layer to the question “why are NFTs bad.”

The Reality Of Unsellable NFTs

While NFTs have been sold for staggering amounts, the reality is that not all NFTs find buyers, leading to a growing concern over unsellable NFTs. Several factors contribute to this situation:

- Market Saturation: As more creators and investors flood into the NFT space, the market is becoming increasingly saturated. This saturation makes it harder for individual NFTs to stand out, reducing their likelihood of being sold.

- Speculative Nature: Many NFTs are bought for speculative purposes, with the hope of reselling for a profit. When the speculation bubble bursts, or if the hype dies down, the value of these NFTs can plummet, making them difficult to sell.

- Lack Of Intrinsic Value: Some NFTs may lack intrinsic artistic or collectible value, being created solely for the purpose of capitalizing on the trend. These NFTs may struggle to find a market.

- Liquidity Issues: The NFT market is not as liquid as other investment markets. Selling an NFT, especially at a desired price point, can be challenging and time-consuming.

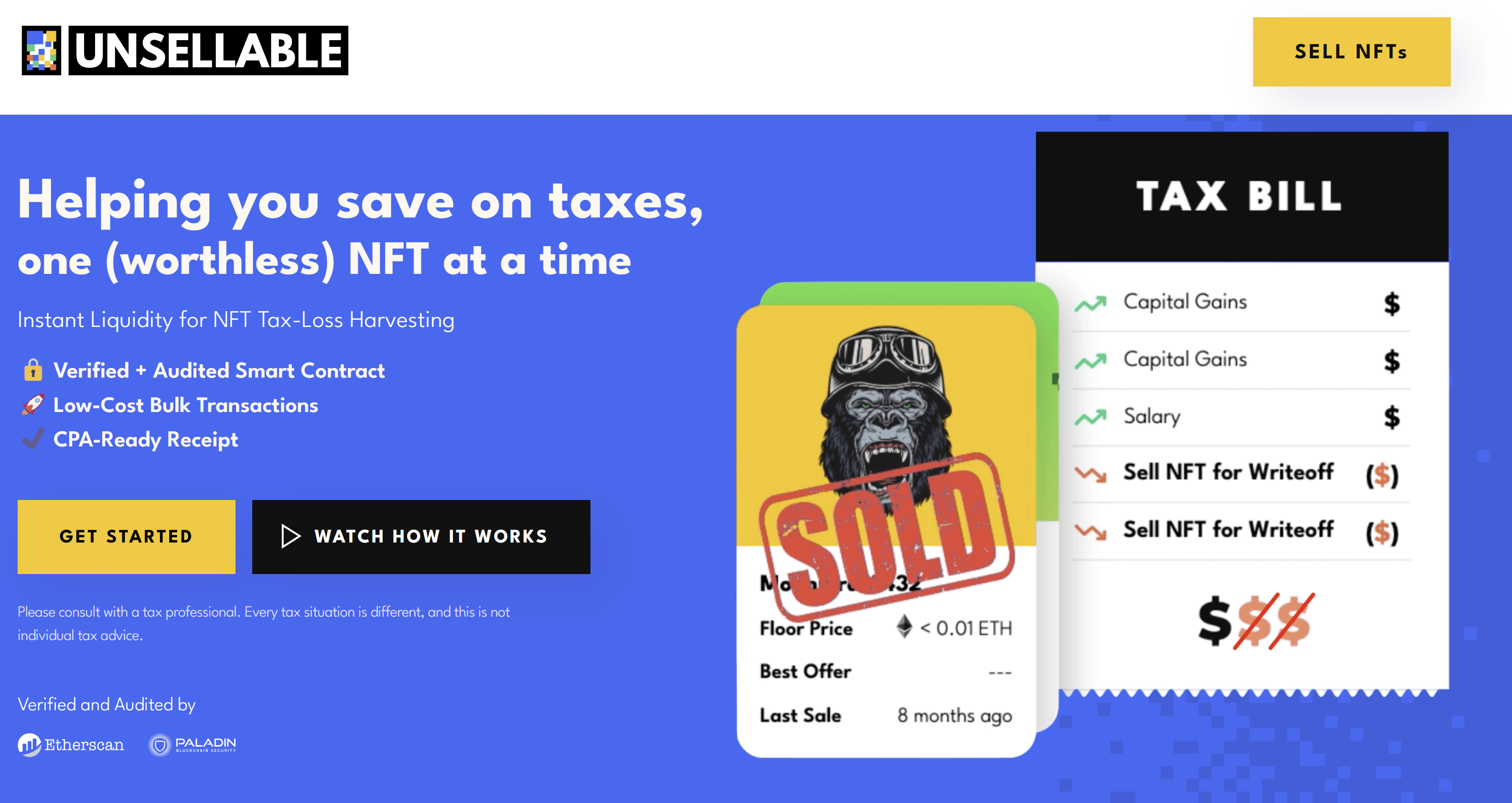

Platforms like Unsellable specialize in purchasing these low-value NFTs for tax write-off purposes.

Are NFTs Bad?

The question “Are NFTs bad?” is complex. NFTs themselves are a neutral technology with potential for positive use, such as supporting artists and creating unique digital experiences. However, the issues of market saturation, speculative bubbles, and technical concerns add a negative aspect to this technology. The answer largely depends on how NFTs are used and the awareness of the buyers and sellers about the risks involved.

Are NFTs Safe?

The safety of investing in NFTs is a matter of perspective and depends on various factors:

- Technical Issues: NFTs on Ethereum face several problems that investors should be aware of.

- Market Volatility: The high volatility of the NFT market can lead to significant financial risks for investors.

- Legal and Technical Risks: As discussed earlier, there are legal ambiguities and technical challenges associated with NFTs, which can impact their long-term viability.

- Scams And Fraud: The NFT space, like any emerging market, is susceptible to NFT scams and fraudulent activities, which can pose risks to less experienced investors.

NFT Laws: Legal Challenges

Navigating the complex legal landscape of NFTs poses a challenge, given that these digital assets intersect various aspects of law in ways that are still evolving and being defined. The dynamic and rapidly evolving nature of NFTs has left lawmakers and stakeholders working to catch up with the legal implications which adds another argument to the question “why are NFTs bad”.

NFT Laws Decoded

The application of existing laws to NFTs is a challenging task, primarily because NFTs are a novel concept that doesn’t fit neatly into traditional legal categories. Intellectual property rights are at the forefront of legal concerns. When someone purchases an NFT, they acquire a token that represents ownership, but the extent of this ownership is often misunderstood. It rarely includes the right to reproduce or distribute the underlying digital asset, leading to potential legal disputes over copyright infringement and ownership rights.

Consumer protection laws are also critical in the NFT marketplace. These laws are designed to protect buyers from deceptive practices. However, the decentralized and often anonymous nature of blockchain transactions makes the enforcement of such laws challenging. The risk of fraud and misrepresentation is high, and buyers may find themselves with limited recourse in cases of dispute.

The classification of NFTs under financial regulations is another area of legal ambiguity. The structure and nature of certain NFTs might classify them as securities. For example, the US Securities and Exchange Commission charged Stoner Cats 2 for conducting an “unregistered offering of crypto asset securities,” depending on their specific characteristics. This categorization subjects them to stringent regulatory requirements, including registration and disclosure obligations under securities laws. However, the lack of clear guidance from regulatory bodies creates uncertainty for NFT issuers and investors.

NFT Legal Issues: A Detailed Analysis

Legal issues in the NFT space are diverse and multifaceted. Copyright and ownership disputes are common, particularly as the lines between digital ownership and copyright ownership are blurred. These disputes often involve multiple parties, including artists, digital platforms, and collectors, each with differing interpretations of their legal rights.

Smart contracts, which are the backbone of NFT transactions, present their own set of legal challenges. While these contracts are designed to be self-executing and immutable, they are not immune to legal scrutiny. Disputes can arise when the terms encoded in smart contracts conflict with statutory laws or when there are errors in the code. The resolution of such disputes often requires litigation, which can be complex and costly.

Taxation of NFT transactions is an emerging area of legal concern. The tax implications for buying, selling, or creating NFTs are not straightforward, and tax authorities are still determining how to apply existing tax laws to these transactions. This uncertainty complicates financial planning for participants in the NFT market and raises the risk of unintended tax liabilities.

The Evolving Landscape Of NFT Legality

As the NFT market continues to grow, so does the legal framework that surrounds it. Governments and regulatory bodies worldwide are beginning to recognize the need for specific regulations that address the unique aspects of NFTs. These emerging regulations aim to provide clarity and stability to the market, but they also bring new compliance challenges.

The global nature of NFT transactions adds another layer of complexity. NFTs are often bought and sold across international borders, bringing into play different legal jurisdictions and regulatory standards. Harmonizing these diverse legal systems is a daunting task and one that is critical for the development of a cohesive global NFT marketplace.

Legal cases involving NFTs are increasingly making their way through courts, setting important precedents that will influence future legal interpretations and regulations. These cases cover a range of issues, from copyright disputes to the enforceability of smart contracts, and their outcomes will have significant implications for the NFT industry.

In conclusion, the legal challenges surrounding NFTs are as dynamic and multifaceted as the technology itself. From intellectual property concerns to regulatory compliance, the legal aspects of NFTs require careful navigation. As the market evolves, so too will the laws and regulations that govern it, shaping the future of this innovative digital asset class.

The Problem With NFTs

The world of Non-Fungible Tokens (NFTs) is marked not only by innovation and opportunity but also by significant problems that raise concerns and contribute to the question, “Why are NFTs bad?”.

Analyzing More Of The Problem With NFTs

A closer look reveals several underlying problems with NFTs:

- Perceived Value Vs. Real Value: A core problem with NFTs is the disconnect between their perceived and real value. The worth of many NFTs is often driven by hype and speculation rather than tangible artistic or utilitarian value. This discrepancy can lead to a volatile market where prices do not reflect the true value of the underlying digital asset.

- Cultural And Ethical Concerns: The NFT craze has raised cultural and ethical questions. It challenges traditional notions of art ownership and creation, potentially commodifying artistic expression in unprecedented ways.

- Impact On Artistic Integrity: For artists, the lure of NFTs can sometimes lead to a compromise in artistic integrity. The pressure to create content that is more likely to sell in the NFT market can influence artistic decisions, potentially leading to a homogenization of digital art.

- Accessibility And Digital Divide: The NFT ecosystem tends to favor those with access to specific technological resources and knowledge. This digital divide excludes a large segment of potential creators and collectors, particularly those from underprivileged backgrounds or regions with limited access to advanced technology.

Blockchain Legal Issues

Earlier discussions have addressed the legal challenges of blockchain, the underlying technology of NFTs, but further exploration reveals additional nuances worth considering:

- Data Privacy Concerns: Blockchain’s transparency and immutability, while strengths, also raise data privacy concerns. Once on the blockchain, information becomes almost impossible to remove, potentially leading to privacy issues, especially with personal data involved.

- Smart Contract Liabilities: Smart contracts are prone to coding errors or unforeseen legal implications. These liabilities can lead to complex legal scenarios where the responsibilities and liabilities of parties in a blockchain transaction are unclear or disputed.

- Cross-Border Enforcement: Enforcing legal decisions across borders is a significant challenge in blockchain transactions. When a dispute arises, the international and decentralized nature of blockchain makes it difficult to enforce judgments or legal actions.

- Emerging Legal Frameworks: As governments and regulatory bodies start to catch up with blockchain technology, new legal frameworks are emerging. These frameworks aim to address the unique challenges posed by blockchain but also create a shifting legal landscape that can be difficult for participants to navigate.

In conclusion, the problems with NFTs extend beyond simple technical or market issues, encompassing broader cultural, ethical, and legal challenges. As the NFT space matures, addressing these multifaceted problems will be crucial for its sustainable and responsible growth.

FAQ: Why Are NFTs Bad?

This FAQ section aims to succinctly address some key questions surrounding NFTs, especially everything about the questions “why are NFTs bad?”

Why Are NFTs Bad?

Critics often target NFTs for their environmental impact, market volatility, and legal uncertainties. Concerns also include the potential for exacerbating the digital divide. The perspective on whether NFTs are “bad” varies based on individual viewpoints and contexts.

NFT Laws: What Investors Should Know?

Investors should note that the legal framework around NFTs is evolving. Key considerations include copyright and financial regulations, as well as the market’s inherent volatility and potential legal risks.

Are NFTs Unsellable?

Not all NFTs are unsellable, but market saturation and fluctuating values can affect their salability. The speculative nature of the market adds to the uncertainty regarding the sale and value of NFTs.

Are NFTs Bad?

Whether NFTs are “bad” is subjective. While they offer innovative digital asset ownership, their environmental costs, potential for market manipulation, and legal challenges are significant drawbacks.

What Is The Problem With NFTs?

The main issues with NFTs include environmental concerns, market instability, accessibility challenges, and legal ambiguities, highlighting the need for sustainable practices and clear regulations.

What’s The Problem With NFTs?

NFTs face environmental, economic, legal, and ethical challenges, including energy consumption, market fluctuation, and impacts on artistic and cultural values.

Are NFTs Legal?

NFTs are legal, but they operate in a complex regulatory landscape that varies across regions. The legality involves considerations around transactional frameworks and compliance with existing laws.

Featured image from Shutterstock