Should Holders Prepare For More Losses?

Bitcoin bulls have had a torrid week. Looking at the price action in the daily chart, not only is the coin down roughly 7% after breaching $70,000 early this week, but cracks are beginning to form. Overall, optimistic traders maintain that the uptrend remains, considering the sharp expansion between July 14 and 21. However, since then, prices have been choppy and mostly moving lower, signaling the possible presence of bears.

More Pain For Bitcoin Holders?

In light of this volatile price action, one analyst is cautious of what lies ahead, even predicting that Bitcoin might, after all, continue dropping in the sessions to come. Taking to X, the analyst shared trading data, which suggests that bears are in control, at least for now.

Specifically, the analyst noted that the weekly clusters of liquidation volume have been increasing, coinciding with the recent price drop over the past trading day. With this signal printing, the analyst is convinced that bears might continue pushing the coin lower at least in the next week.

While this prints out, the net taker volume across leading perpetual exchanges remains negative. The net taker volume, which on-chain analysts use to gauge market sentiment, fluctuates depending on market valuation.

When the net taker volume sinks into negative territory, it suggests that most traders are taking short positions. According to the analyst, prices might recover only when this reading turns green, allowing bulls to take charge of the market.

Looking at the Bitcoin daily chart, buyers have support at around the $63,000 level. However, a level higher, the zone between $60,000–a round number–and $63,000 will be critical.

If bulls hold this level, preventing sellers from pushing prices lower, the odds of Bitcoin recovering will be high. Any expansion above $70,000 would be crucial and in alignment with the bullish trend established in the third week of July.

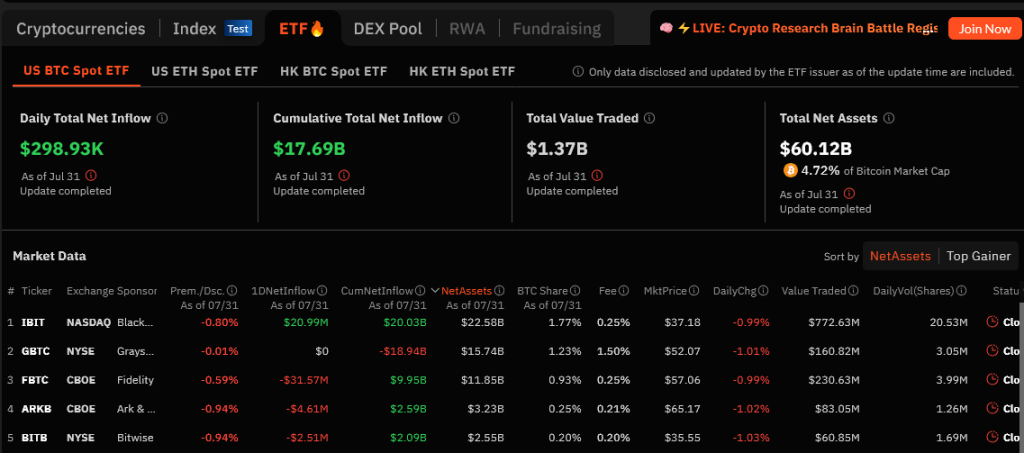

Institutions Accumulating: Spot ETF Issuers Control Nearly 300,000 BTC

Despite the current weakness, institutions are keen to get exposure to Bitcoin. Since the approval of spot Bitcoin ETFs in the United States, Ecoinometrics data shows that leading issuers like Fidelity and BlackRock have accumulated nearly 300,000 BTC.

On August 1, Soso Value data revealed that all spot Bitcoin ETFs hold over $60 billion worth of BTC. On July 31 alone, BlackRock purchased nearly $21 million worth of BTC.

Even so, there were major outflows from other issuers, mainly Fidelity. That institutions are doubling down, accumulating the coin is overly bullish for Bitcoin, especially in the long term.

Feature image from Canva, chart from TradingView