Pantera Capital praises Solana as Ethereum’s dominance shifts to ‘multi-polar model’

The crypto venture firm Pantera Capital says Ethereum’s losing steam as Solana has become a “major contender for the future of blockchain development.”

Pantera Capital, a crypto venture capital firm managing billions in assets, reportedly eyeing a purchase of millions worth of SOL from the bankrupt FTX exchange, appears to be increasingly highlighting Solana’s potential over Ethereum to investors.

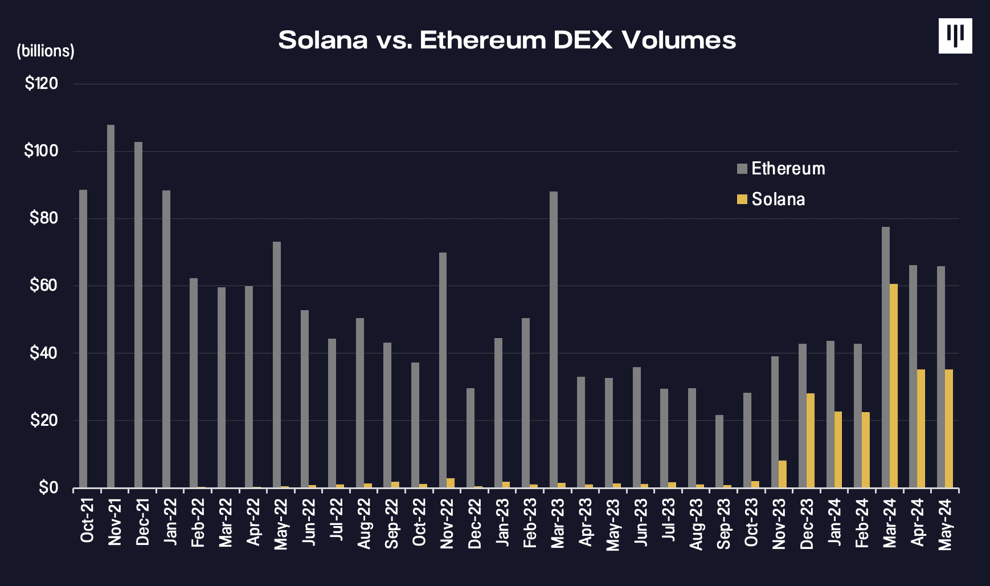

In a Jun. 18 newsletter, the Menlo Park-headquartered venture capital firm said Ethereum’s dominance “appears to be yielding to the multi-polar model,” pointing to Solana as a new prominent product that gained “significant share over the past year.”

“The shift is reminiscent of Microsoft’s dominance of the early desktop computer market, until Apple broke through with its vertically integrated approach. Solana is now a major contender for the future of blockchain development.”

Pantera Capital

Drawing parallels to Apple‘s breakthrough in the early days of personal computing, Pantera likened Solana’s integrated approach to Apple’s vertically integrated strategy with macOS, saying the network’s monolithic architecture has a product roadmap “focused on optimizing every component of its own blockchain.”

The venture capital firm says Solana’s “architectural advantages” enable a range of use cases and user experiences that “may be more challenging to implement on modular blockchains like Ethereum and Cosmos,” citing Solana’s “fast, low-cost transactions.”

“Solana’s architectural advantages are enabling it to capture an outsized share of the new demand coming into the blockchain space, accelerating its ascent as a rival to Ethereum.”

Pantera Capital

The firm’s endorsement of Solana follows reports saying that Pantera Capital was among the bidders for SOL tokens auctioned by FTX during its bankruptcy proceedings earlier this year, buying a significant stake in the tokens. Reports indicate that Pantera Capital was interested in buying auctioned SOL tokens amounting to as much as $250 million, although the precise amount acquired hasn’t been disclosed.