Lightning Network Proves More Efficient Than Credit Card Processors

Comparing Bitcoin’s Lightning Network to legacy credit card processing makes it clear that Lightning settles payments much more efficiently and affordably.

The article below is an excerpt from a recent edition of Bitcoin Magazine PRO, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

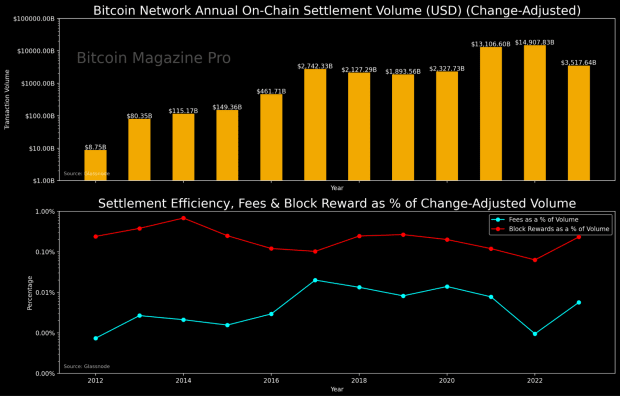

The traditional use of the Bitcoin network for on-chain settlement is extremely efficient by settling transactions approximately every 10 minutes. Bitcoin might be most closely related to the Fedwire Funds Service which only settles about 200 million transactions per year compared to Bitcoin’s trailing 1-year figure of 98.5 million transactions.

As it stands today, the Bitcoin network is on pace to settle $3.5 trillion worth of change-adjusted value over the course of 2023, for costs of just $198 million, an equivalent fee rate of 0.006% for the average transaction. While average transaction costs are obviously skewed by the largest transfers in the data set, we can look at the median transaction settlement value and account for the median transaction fee, and still see that on-chain bitcoin transactions are a tremendously efficient way to send and receive value in a trustless manner over the internet.

Despite bitcoin’s extreme efficiencies as a global immutable settlement network, it remained unideal for minuscule and instantaneous transfers, as the 10-minute block interval target adds a latency to the settlement of transactions. This is okay for large sums of money, evidenced by the incumbent financial system, where net settlement of funds between financial intermediaries often don’t finalize for days or weeks on end — think MasterCard or Visa settling their books on a net basis with a banking institution like JPMorgan.

However, the need for a sound internet money that could settle instantaneously for nearly no cost was still there. With the advent of the Lightning Network, the latency involved with sending a bitcoin transaction, particularly for micropayment settlements, has all but vanished. This has brought about a whole new use case for bitcoin, as the monetary medium is now finding itself being inserted into the tech stacks of web applications and services across the globe.

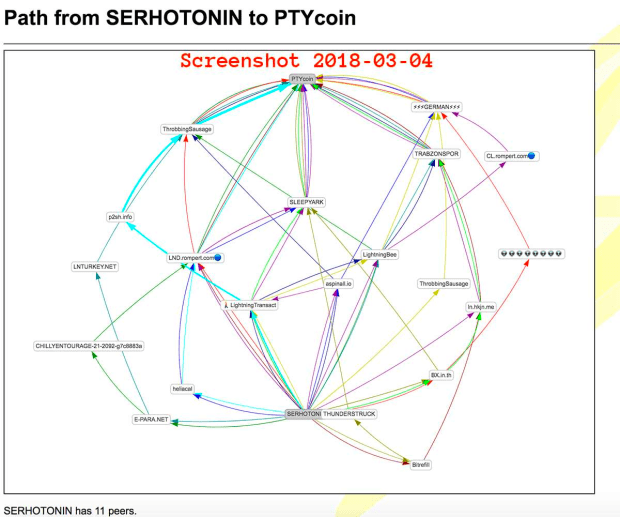

As a refresher and overly simplified description, the Lightning Network works by node runners doing an on-chain transaction to open up payment channels with other nodes. This adds liquidity to the network and creates a network of channels when enough users open channels to one another. Lightning payments are sent from one node and hop across other nodes who have enough liquidity in their channels until the payment reaches its intended destination.

By doing one on-chain payment to open a channel, funds on the Lightning Network are able to move with less friction and settle without waiting for 10-minute periods between blocks for each transaction, until the channel gets closed with another on-chain transaction. These channels allow for lower fees as payments only pay to hop across nodes that have liquidity in their channels.

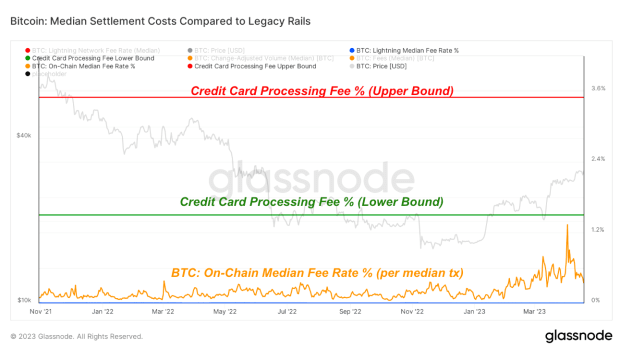

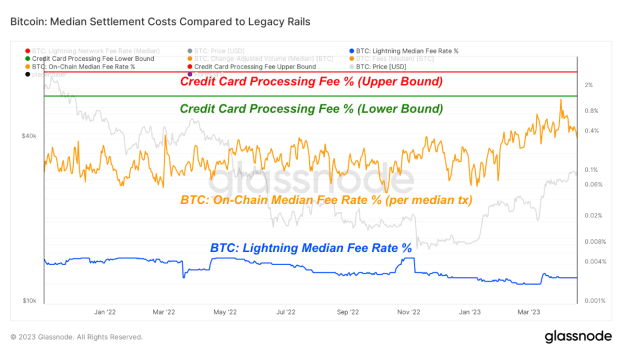

With a refresher on the technical workings out of the way, let’s take a look at the costs of the Bitcoin settlement stack compared to current retail settlement options like credit cards and focus on the massive efficiency gains of the Lightning Network in particular. Shown below, we compare the upper- and lower-bound costs of legacy payment processors to the median settlement cost of a Bitcoin on-chain transaction — median fee paid divided by median transaction volume — and the Lightning median fee rate percentage for sending the equivalent of 1 BTC.

We acknowledge that the comparison between the median cost of a bitcoin on-chain transaction to legacy payment processing costs isn’t quite an apples-to-apples comparison because credit card processors allow for near instantaneous payments to be made (but not settled!). That being said, this is where the vast efficiencies of the Lightning Network come into play.

The same chart above is also displayed below, in logarithmic scale, in order to provide a more representative visual.

The two charts above demonstrate how much more cheaply the Lightning Network is settling payments when compared to credit card processors.

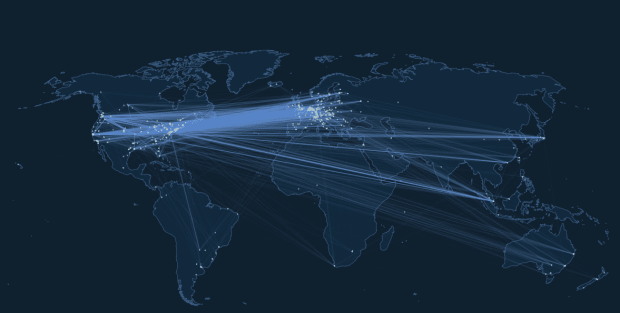

Yes, legacy payment processors facilitate the transfer of trillions of dollars a year, which dwarfs the Lightning Network’s settlement volume. As a side note, it isn’t possible to quantify the transfer volume of Lightning like it is with on-chain transactions. Given the relative size of the Lightning Network, it is vital to remember that the network has continued to grow exponentially, while facilitating instantaneous transfer for near-to-no cost, all the while growing ever more connected.

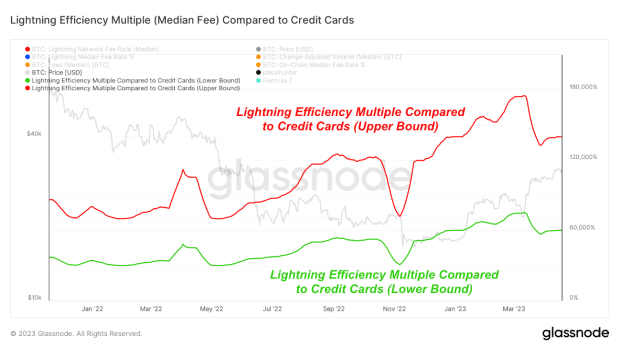

In addition to cheaper settlement, the Lightning Network is also facilitating payments 60,000% to 140,000% more efficiently than credit cards.

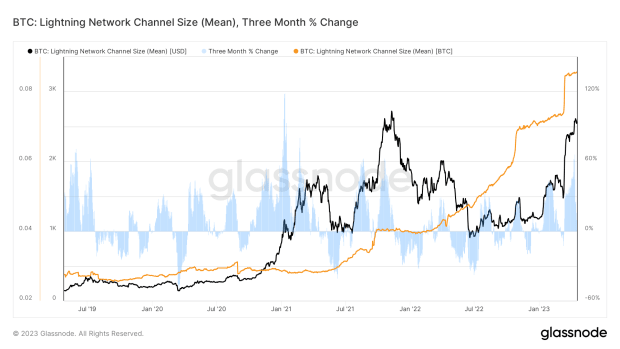

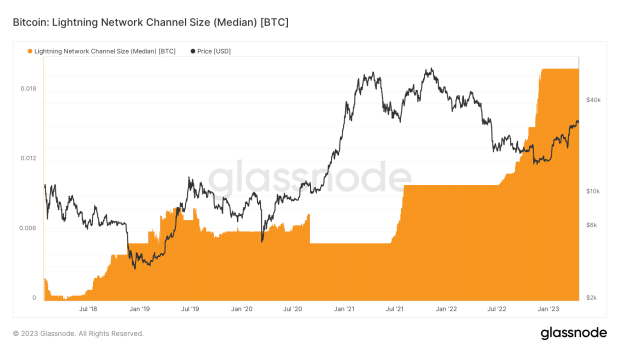

While it may be a bit of a stretch to directly compare the median lightning payment fee to that of a multinational credit card processing firm, particularly given the minuscule micropayments of many Lightning transactions, the nature of public Lightning channels and transactions means that this technology is very capable of scaling to accommodate much larger transactions if/when needed. There is already indirect evidence of this happening with the average size of public channels pushing all-time highs in both BTC and USD terms at the time of writing.

Much of our recent focus has been on the economic opportunity of bitcoin in terms of the total addressable market of stocks, bonds and other stores of value, but we find the current development and growth of the Lightning Network to be extremely compelling.

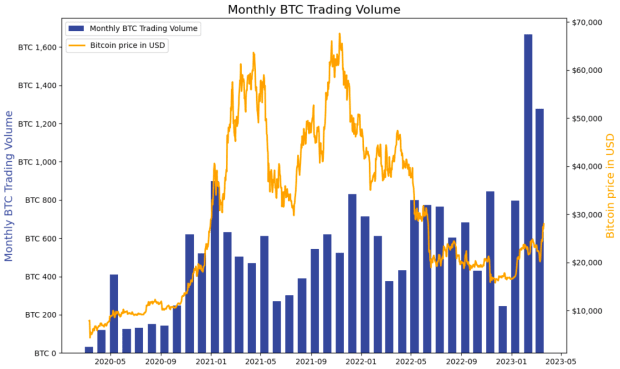

The Lightning Network has a flourishing ecosystem that is continuously growing, with micropayments being integrated into paywalled media content, value-for-value platforms, crowdfunding opportunities, tipping on social media (Hello nostr), bitcoin derivative marketplaces such as LN Markets (which is seeing trading volumes at all-time highs) and more.

Final Note:

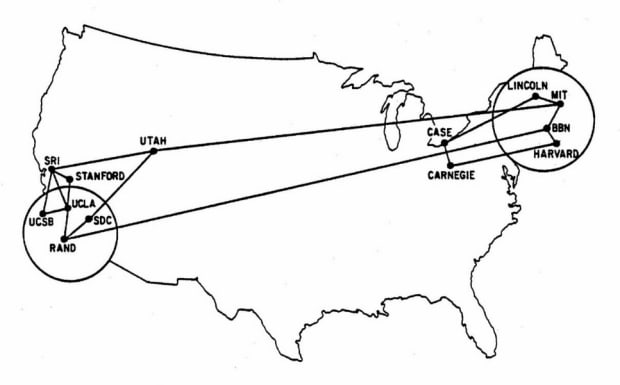

First enabled by the Segwit soft fork in 2017, the Lightning Network has gone from a conceptual idea to a flourishing global ecosystem in the span of less than six years. Reminiscent of the early days of the internet, Lighting Network nodes and user participation has gone from niche hyper-technical software developers to the edge of mainstream adoption in a short amount of time.

While the Lightning Network may not be headline news, the technology enabled by Lightning — the ability to direct a digitally native bearer asset in a trustless manner across the internet for nearly no cost — is an extremely significant development in the history of payment networks, and it is the first to do so in an open and decentralized manner.

We are extremely bullish on the continued development and adoption of the Lightning Network, and think that the advent of a common open-standard for sending and receiving internet-native value instantaneously for extremely low costs may be the killer app that brings bitcoin to a billion people.

It’s helpful to compare the early days of the internet to where Bitcoin is in its lifecycle. Looking at the growth of the two networks below can give us a small glimpse into where Bitcoin and Lightning may be heading as adoption increases.

How the internet started:

How its going:

How the Lightning Network started:

How its going:

That concludes the excerpt from a recent edition of Bitcoin Magazine PRO. Subscribe now to receive PRO articles directly in your inbox.