Largest Korean Exchange Has 87% Alt Volume

Data shows Upbit, the largest Korean cryptocurrency exchange, has the altcoins contributing to 87% of the total trading volume.

87% Of The Trading Volume On Upbit Is Occupied By Altcoins

In a new post on X, CryptoQuant founder and CEO Ki Young Ju has posted a comparison of the trading volumes between American and Korean cryptocurrency exchanges.

The “trading volume” here refers to the total amount of any given cryptocurrency (or multiple coins) that’s becoming involved in some kind of trading activity on a particular platform or group of platforms.

When the value of this metric is high, it means a large number of tokens of the asset are being shifted on the platform currently, which can suggest that trading interest around it is high from the exchange’s users.

On the other hand, low values imply the coin in question may lack any interest from the investors as not too much of it is becoming involved in trading activities on the platform.

Now, here is a chart that shows how the share of trading volume that Bitcoin, Ethereum, and the altcoins individually contribute on cryptocurrency exchanges Coinbase and Upbit has changed over the past year:

The distribution of the trading volume across these two platforms | Source: @ki_young_ju on X

As is visible above, Coinbase, the largest American exchange, has the altcoins contribute the largest share to trading volume right now, but their dominance isn’t something too overwhelming.

Upbit, the largest Korean platform, on the other hand, has the alts making up $34.2 billion in volume, which is equivalent to 87% of the total volume on the exchange at the moment.

This would suggest that Korean users have a greater relative interest in the altcoins than American investors, who also trade Bitcoin and Ethereum a fair amount.

This difference in behavior may be down to the type of investors that visit the respective platforms. As Ju has noted in reponse to a user commenting on the post, “The volume is primarily from retailers, mainly because Korean exchanges prohibit institutional investors and foreign users by law.”

Coinbase, however, is widely known to be used by institutional investors, so although retailers would also be on the platform, the trading volume distribution would be skewed by these humongous entities.

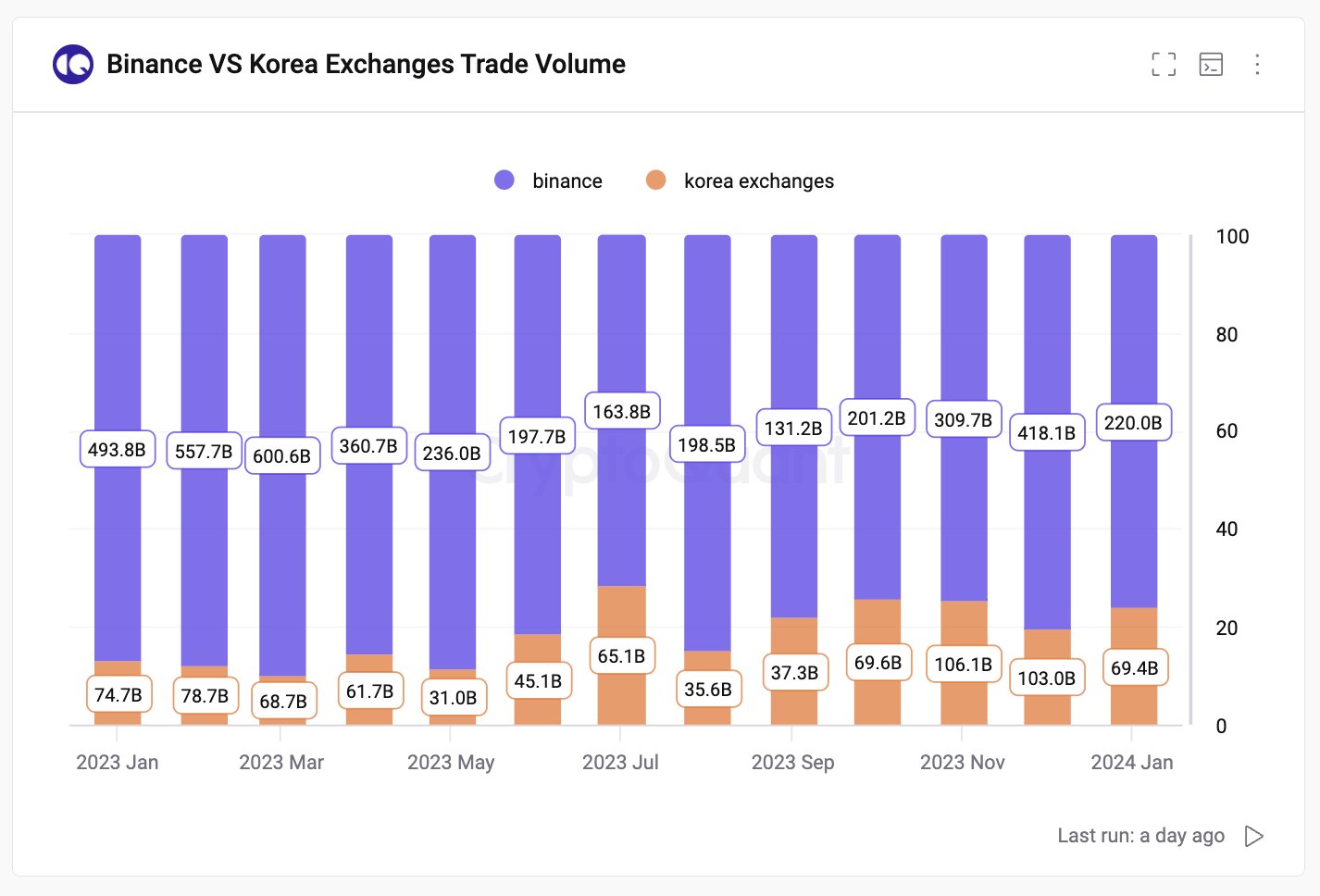

To give perspective on the position of the Korean platforms in the greater industry, the CryptoQuant founder has shared a chart that compares the trading volume of these exchanges with Binance.

How the volumes on the two platforms have compared over the past twelve months | Source: @ki_young_ju on X

From the graph, it would appear that the total volume on Korean exchanges right now ($69.4 billion) is around 31% of the volume on Binance ($220 billion). The latter is the largest cryptocurrency exchange in the world based on trading volume.

According to the analyst, this means that the altcoin-dominant Korean exchanges have a 12% global influence.

BNB Price

BNB, the largest altcoin in the sector, has enjoyed a 4% jump during the past 24 hours, which has now taken its price to $316.

Looks like the altcoin has observed a sharp rise over the last day | Source: BNBUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, CryptoQuant.com