Klarna Takes Crypto Leap, Planning Stablecoin Launch In 2026

Swedish fintech firm Klarna has entered the cryptocurrency space with the announcement of a USD stablecoin, set to roll out in 2026.

Klarna To Launch Stablecoin On Tempo Blockchain

As announced in a press release, Klarna has launched its stablecoin on Tempo’s testnet. The stablecoin, called KlarnaUSD, is backed one-to-one by the US Dollar, and will be available to the public in 2026.

Klarna is a global digital bank and payments provider headquartered in Sweden, with the US hosting its largest userbase. The stablecoin debut represents the first venture of the fintech company into digital assets.

KlarnaUSD is built using Bridge’s Open Issuance, a platform that allows businesses to launch and manage their own stablecoins. It runs on Tempo, a blockchain created by payments processor Stripe and crypto investment firm Paradigm that advertises itself as being designed for payments.

Stripe also owns Bridge after its acquisition earlier in the year. “The partnership deepens an already extensive relationship between Klarna and Stripe, which spans payments infrastructure across Klarna’s 26 markets globally,” noted the announcement.

Since the blockchain allows for quick and cheap payments, Klarna believes that stablecoins could be a way to cut down on cross-border transaction fee costs, which are estimated to cost merchants and consumers $120 billion annually.

Stablecoins have been gaining more adoption across the globe, with positive regulation coming from various governments this year. Management consulting firm McKinsey has estimated that transactions related to these fiat-pegged cryptocurrencies now touch $27 trillion a year, and could eclipse legacy payment networks before the decade is over.

Sebastian Siemiatkowski, Klarna co-founder and CEO, said:

With 114 million customers and $112 billion in annual GMV, Klarna has the scale to change payments globally: with Klarna’s scale and Tempo’s infrastructure, we can challenge old networks and make payments faster and cheaper for everyone

Currently, Klarna is prototyping the stablecoin on Tempo’s testnet, but it will not be open publicly until the mainnet launch next year. The move appears to only be a beginning in the cryptocurrency sector for the buy-now-pay-later firm, as the press release has teased the reveal of its next partner in the coming weeks.

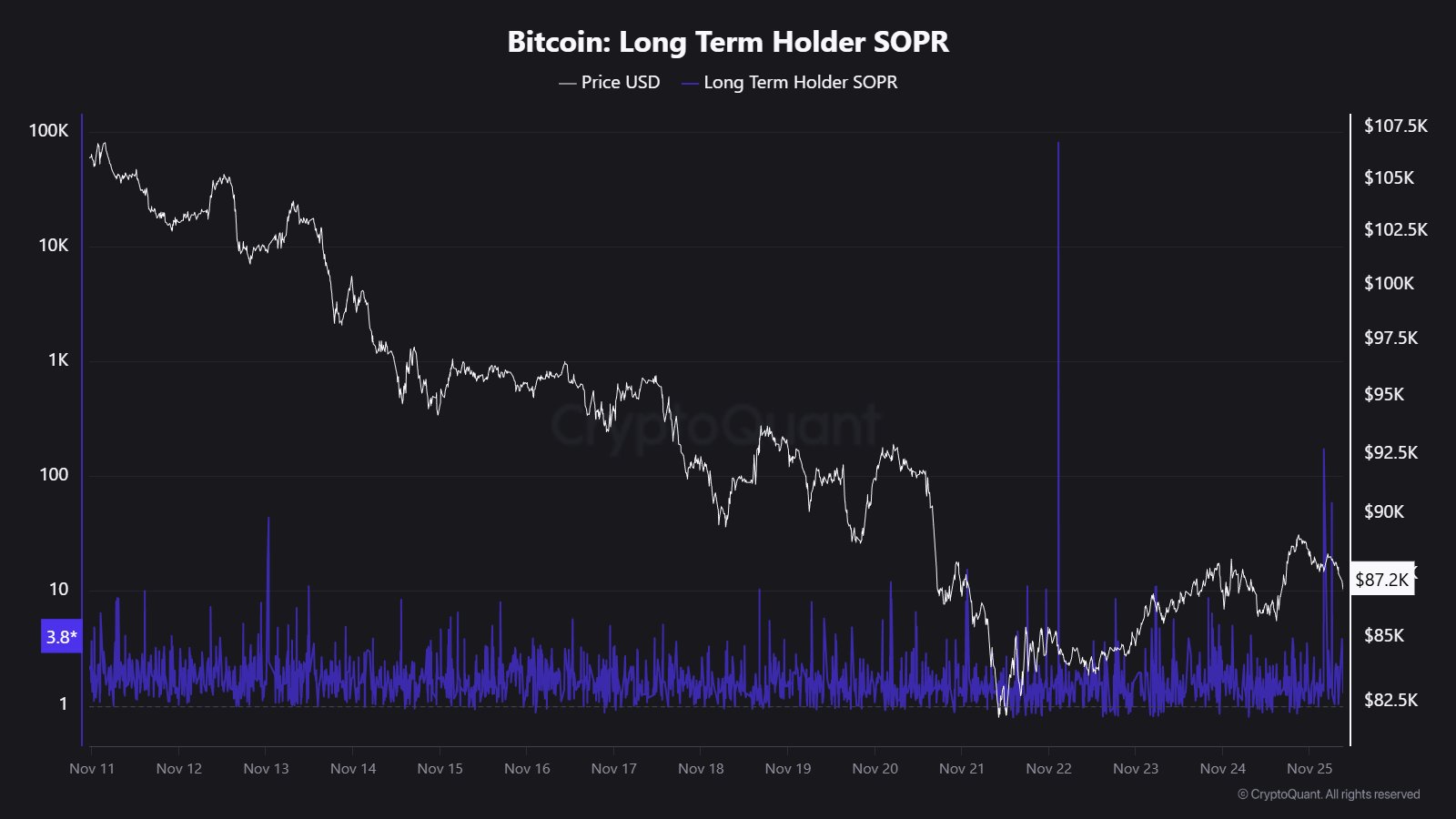

In some other news, CryptoQuant community analyst Maartunn has spotted a curious transaction on the Bitcoin blockchain. The move in question induced a spike of 80,472 on the long-term holder SOPR, an indicator that tracks the profit-loss ratio of transfers involving coins from dormant hands (155+ days of holding time).

The trend in the BTC LTH SOPR over the last few weeks | Source: @JA_Maartun on X

At the time the transaction occurred, BTC was trading around $84,000. Considering the profit-loss ratio of the move was 80,472, the coins must have had a cost basis close to $1.

Maartunn dug into blockchain data and found that the transfer came from a wallet that originally held 13 BTC mined back in 2013, and has been selling roughly 1 BTC every year since 2018.

BTC Price

Bitcoin recovered above $89,000 on Monday, but the coin has since seen a setback as it’s now back at $86,200.

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.