Ethereum Consolidates Against BTC – Altseason Hopes Hinge On ETH/BTC Breakout

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is showing impressive resilience as it continues to hold above critical levels despite ongoing market volatility. While Bitcoin struggles to break past its all-time highs, ETH remains stable, maintaining bullish structure and fueling hopes for a broader altcoin rally. Analysts across the market are eyeing a potential altseason, with Ethereum expected to lead the charge once it clears major supply zones.

Related Reading

However, the spotlight is shifting to a less discussed but highly significant chart—ETHBTC. According to top analyst Daan, the ETHBTC pair has been consolidating in a tight range between 0.022 and 0.026 since the last squeeze. This consolidation suggests a period of accumulation and reduced volatility, but it also acts as a crucial signal for altcoin momentum.

If ETHBTC breaks above the 0.026 resistance level, Daan suggests it could trigger a temporary but powerful rally in ALT/BTC pairs. Sectors closely tied to Ethereum—such as DeFi protocols, ETH-based memecoins, and Layer 2 ecosystems—could benefit most from such a move. Until then, investors are closely monitoring ETH’s performance relative to BTC, as it remains one of the most reliable indicators of capital rotation within the crypto market.

ETHBTC Chart Becomes Key to Altseason Outlook

Ethereum is currently trading at a pivotal range, with investors closely watching for a breakout that could lead to new highs and potentially ignite the long-anticipated altseason. Despite global tensions and continued macroeconomic uncertainty—particularly surrounding the aggressive and unstable Bond market—ETH has remained relatively strong. Bulls are optimistic, viewing the current consolidation as a healthy pause before the next leg up.

One of the most important signals for altcoin momentum is not found on the USD chart, but in the ETHBTC pair. Daan points out that Ethereum’s price relative to Bitcoin has been consolidating between the 0.022 and 0.026 BTC range since the recent squeeze. This range now acts as a pressure point for the market. A breakout above 0.026 would likely catalyze a surge in altcoin strength, especially among Ethereum-related assets like DeFi protocols, ETH-based memecoins, and Layer 2 solutions.

However, Daan warns that if ETHBTC drops below 0.0224, it could signal weakness for alts relative to BTC. It’s important to remember that ALT/BTC pairs can fall even if altcoin USD prices rise, particularly during aggressive BTC rallies. The same applies in reverse. For now, ETH’s position in this range remains one of the most telling signs of where the broader crypto market might head next.

Related Reading

Ethereum Faces Resistance As Bulls Attempt Breakout

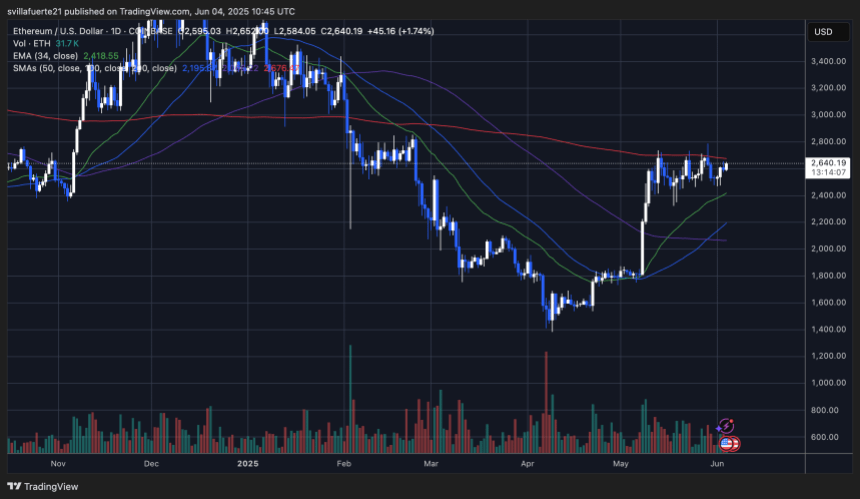

Ethereum (ETH) is currently trading around $2,640, showing signs of strength after holding its ground above the $2,500 mark. On the daily chart, ETH is forming a clear consolidation pattern just below a key resistance zone defined by the 200-day moving average (currently at $2,676). This level has repeatedly capped price action over the past few weeks, signaling strong supply pressure in this area.

Despite the lack of a decisive breakout, Ethereum is maintaining a bullish structure with higher lows and consistent volume support. The 34-day EMA has turned upward and currently sits at $2,418, providing dynamic support and reinforcing the short-term uptrend. If ETH can reclaim the 200-day SMA and push above $2,700, a broader rally could follow, potentially opening the path toward $3,000 and beyond.

Related Reading

On the downside, if price fails to break this resistance and sellers take control, immediate support lies near $2,500, followed by stronger demand around $2,350–$2,400 where the 50- and 100-day SMAs converge. For now, Ethereum remains in a balanced state, showing resilience, but still needs a strong catalyst to overcome the technical ceiling that continues to stall upward momentum.

Featured image from Dall-E, chart from TradingView