dYdX price rebounds, but sell cluster threatens breakout rally

dYdX has embarked on a recovery push amid growth in buying pressure, but a cluster of sell orders threatens its potential for further rise.

dYdX has increased by 4% over the past 24 hours, emerging as the top gainer among the top 100 cryptocurrencies. The upward momentum marks its third consecutive day of intraday gains after it witnessed sustained consolidation on the back of the broader market’s bearish trajectory.

The previous collapse commenced with a sharp 7% drop on July 23, following reports confirming that the exchange’s website had been compromised. dYdX currently trades for $1.127, up 2.07% this morning.

Data from the daily chart confirms that since July 26, dYdX has been carving out a rounding bottom pattern, a favorable reversal signal indicating a potential shift in market sentiment.

This formation suggests that the prolonged downtrend might be nearing its end, with buyers gradually gaining control. However, dYdX is now approaching a multi-week descending trendline that has acted as a formidable resistance.

dYdX must close above the psychologically significant level of $1.60 to confirm a breakout and signal a more substantial bullish reversal.

Adding to the bullish outlook, the Moving Average Convergence Divergence (MACD) indicator on the daily chart shows signs of strengthening momentum. The MACD line (-0.043) has crossed above the signal line (-0.066).

dYdX faces sell order cluster

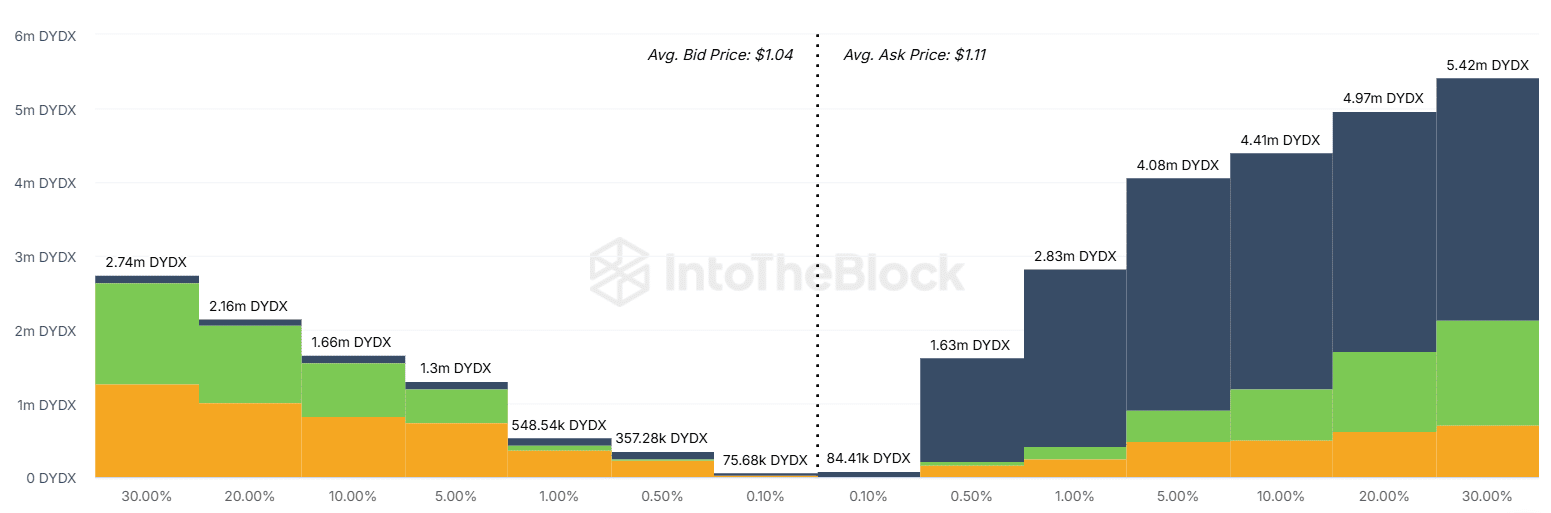

The road ahead is not without challenges, as indicated by the asset’s market depth, according to data from IntoTheBlock. While the average bid price is $1.04, the average ask price is higher at $1.11, indicating that sellers are willing to offload their positions at a premium.

There is substantial resistance above the current price. Sell orders accumulate significantly as the price approaches and surpasses $1.20, with a particularly dense cluster at $1.30 and beyond.

Market depth data also reveals that at levels 10% and 20% above the current price, sell orders dominate, with volumes of 4.08 million dYdX and 4.97 million dYdX, respectively.

This suggests that even if dYdX breaches the $1.20 mark, it could face increased selling pressure, potentially capping further gains unless strong buying interest emerges.

On the downside, dYdX is supported by significant buy orders below the $1.10 level, with notable volumes at $1.00 and $0.90, where large bids could prevent a steep decline. The safety net could provide the necessary support for dYdX to consolidate before attempting another push higher.