Chinese Miners Flock To Ethiopia For Cool Climate, Cheap Electricity And Hot Profits

In a strategic dance between global powers and the allure of untapped resources, Chinese Bitcoin miners are orchestrating a mass migration to Ethiopia. Drawn by the siren call of the nation’s staggeringly low electricity costs and a surprising embrace of Bitcoin mining, Ethiopia has become an unexpected haven for cryptocurrency firms, setting the stage for a unique partnership in the heart of East Africa.

Ethiopia’s Bitcoin Bet: Geopolitical Complexity Unfolds

The collaboration unfolds against the backdrop of Ethiopia’s ban on cryptocurrency trading, paradoxically juxtaposed with the government’s open-armed welcome to Bitcoin mining since 2022. A complex geopolitical ballet, this move aligns with Ethiopia’s efforts to strengthen ties with China, with Chinese firms, instrumental in erecting the $4.8 billion Grand Ethiopian Renaissance Dam, now set to supply power to the surging influx of Bitcoin miners.

As the global Bitcoin mining industry faces a crescendo of criticism for its energy-intensive practices, Ethiopia emerges as a surprising oasis, offering a rare respite for cryptocurrency firms grappling with mounting concerns over climate change and power shortages. For Chinese companies, once giants in the Bitcoin mining arena, Ethiopia’s landscape presents an opportunity to regain their dominance, stepping away from the fierce competition found in the current epicenter of the industry, Texas.

BTC market cap currently at $877.016 billion. Chart: TradingView.com

Yet, this bold move is not without its share of risks, echoing past attempts by developing nations like Kazakhstan and Iran, whose forays into Bitcoin mining were met with internal strife fueled by the industry’s voracious energy appetite. Jaran Mellerud, the chief executive of Hashlabs Mining, offers a sobering perspective, warning of potential pitfalls where countries may exhaust their electricity resources or where miners could find themselves unwelcome and forced to pack up and leave.

A top executive at Bitmain, the Beijing-based company that is the main supplier of rigs, claims that in a few years, the African nation’s ability to generate electricity for the creation of bitcoin may equal that of Texas. Ethiopia’s installed generating capacity expanded to 5.3 gigawatts with the opening of the GERD project; hydropower, a renewable energy source, accounts to over 90% of this capacity, according to the South China Morning Post.

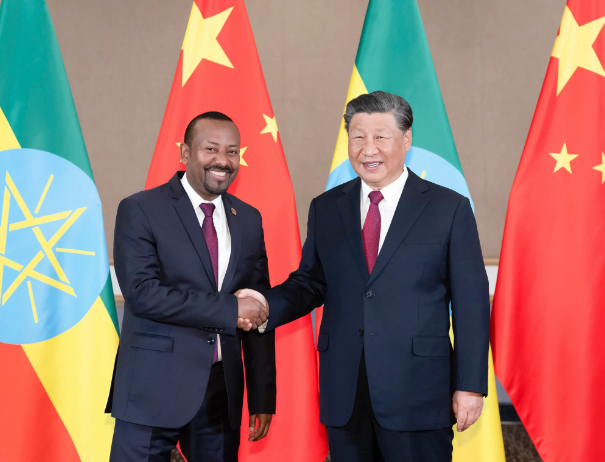

Chinese President Xi Jinping meets Ethiopian Prime Minister Abiy Ahmed on the sidelines of the BRICS Summit in Johannesburg, South Africa, last August. Photo: Xinhua

Ethiopia’s Bitcoin Balancing Act: Opportunity Abounds

Navigating this precarious dance, Ethiopian authorities approach Bitcoin mining with caution. Despite recent strides in increasing energy generation capacity, the glaring reality persists: almost half of the population lacks access to electricity, making the subject of mining a sensitive and nuanced topic. However, the promise of significant foreign exchange earnings acts as a seductive incentive for the government to delicately balance the potential economic windfall against the backdrop of societal concerns.

Luxor Technology, a mining services provider, sheds light on Ethiopia’s rapid ascent to prominence as a global destination for Bitcoin mining equipment. The state-controlled power utility has inked agreements to supply electricity to 21 Bitcoin mining firms, with a predominant Chinese ownership, underscoring the substantial foreign investment influence within Ethiopia’s burgeoning mining sector.

As the first wave of Chinese Bitcoin miners descends upon Ethiopia, the nation stands at the crossroads of economic opportunity and potential peril. This unexpected fusion of Chinese investment and Ethiopian openness to the cryptocurrency realm paints a vivid picture of the evolving dynamics in the global digital financial landscape. Whether this venture proves to be a panacea for Ethiopia’s economic aspirations or a risky gambit with far-reaching consequences remains uncertain, adding an intriguing chapter to the ongoing narrative of cryptocurrency’s global footprint.

Featured image from Adobe Stock, chart from TradingView