Bullish Whales Target $70k Rally

As Bitcoin’s price grazed the $64,000 milestone on Feb. 28, market indicators indicate an imminent rally to new all-time highs above $70,000.

Bitcoin (BTC) grabbed headlines again on Feb. 28, as prices surged to a daily timeframe peak of $64,000, its highest in 830 days. With whale investment metrics still flashing green signals, a new all-time high could be on the cards for the pioneer cryptocurrency.

Bitcoin whales in firm control: Holding 60% of the total supply

The Bitcoin ETF approval was undoubtedly a real watershed moment for the crypto sector. At press time on Feb. 28, the overall market capitalization of the crypto industry has skyrocketed by $450 billion to reach a three-year peak of $2.25 trillion.

The boom in the crypto sector inflows was led by record-breaking demand by 10 newly-launched Bitcoin ETFs, who have jointly acquired over 665,850 BTC, around $40 billion, in less than six weeks of trading.

However, a closer look at the on-chain data shows that aside from the ETF holdings, a broader range of large corporate entities and high net-worth investors have plunged headfirst into the BTC market. The air of legitimacy provided by the U.S. Securities and Exchange Commission’s (SEC) approval verdict has been pivotal to this trend.

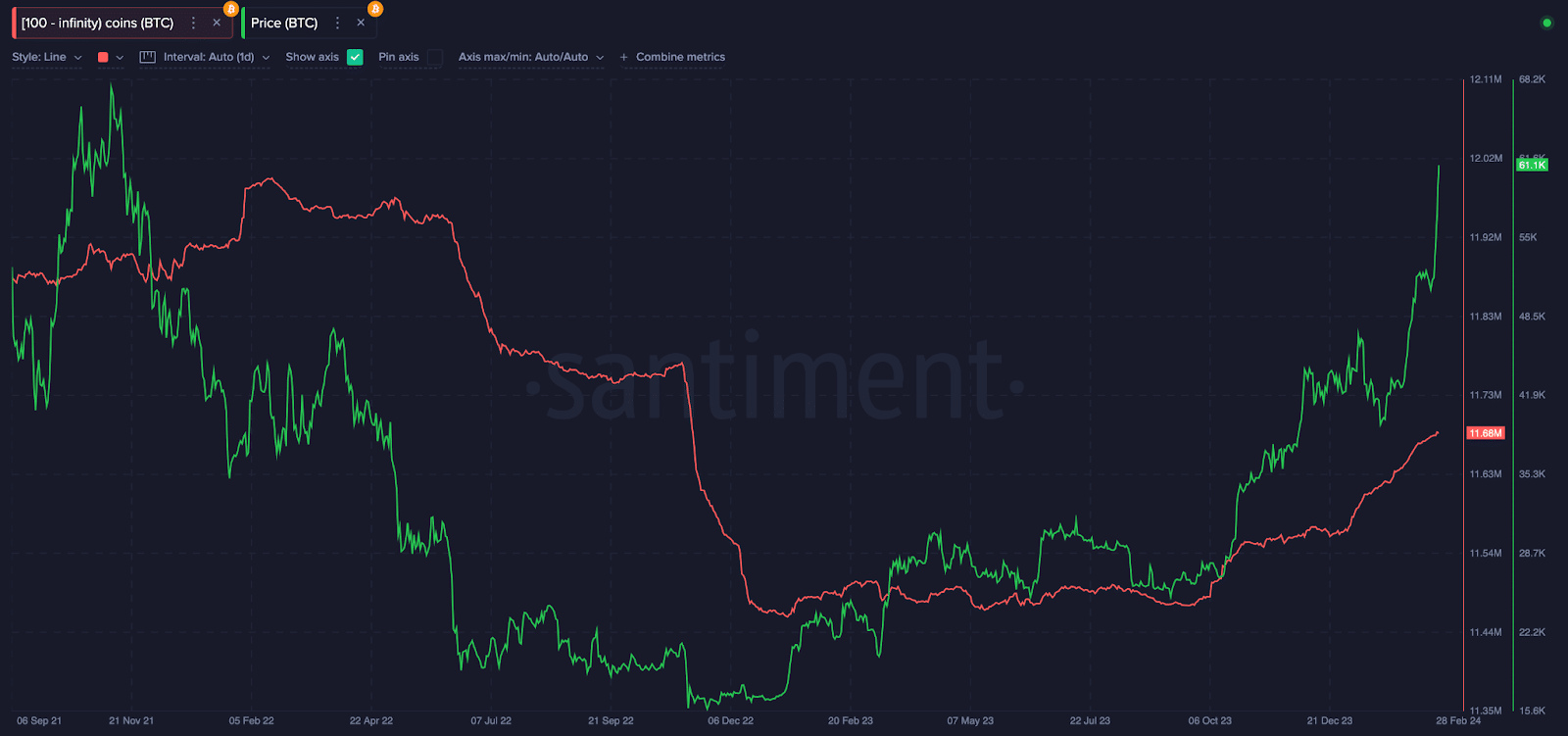

The Santiment chart presents the historical trend of Bitcoin balances held in whale wallets with a minimum of 100 BTC, roughly $600,000. The chart shows that between May 2022 and January 2023, whales rapidly offloaded 500,000 BTC from their holdings.

That period coincided with the TerraUST collapse and the FTX crash of 2022, which reflected severe cases of corporate governance and internal control failure.

Since then, whales have begun repurchasing BTC after the SEC confirmed official Bitcoin filings by BlackRock around September 2023.

In addition to the SEC’s tacit co-sign, the resilience shown by entities like MicroStrategy and sovereign governments seen in El Salvador and the Central African Republic in recent years has also shored up corporate confidence in Bitcoin.

At the time of writing on Feb. 28, the whales now hold 11.7 million BTC worth approximately $714 billion, which accounts for 60% of the total supply currently in circulation, the highest in over two years.

Large institutional investors are known to have a longer-time investment horizon than short-term retail swing traders. Their tendency to accumulate and retain large amounts of BTC effectively reduces the available supply in the market, creating scarcity and exerting upward pressure on prices.

Hence, by controlling a significant share of the market supply, the resurgent Bitcoin whales will likely drive Bitcoin price toward an all-time high above $70,000 in the coming weeks.

Price forecast: Can Bitcoin reach $70,000 in March 2024?

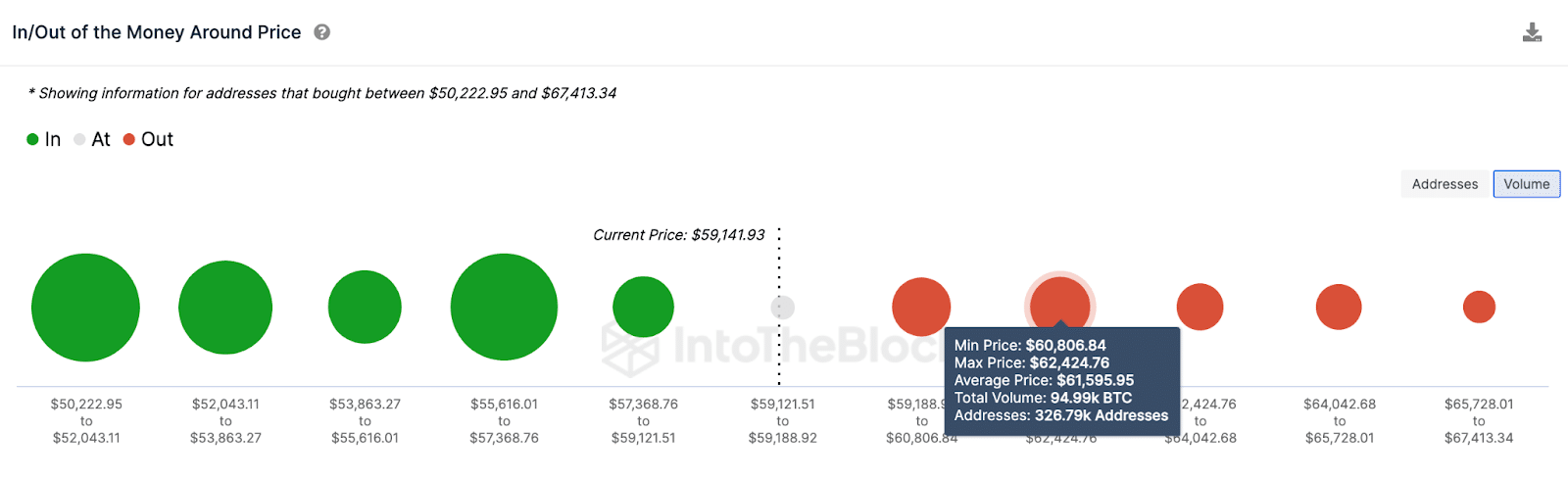

At the time of writing on Feb. 28, BTC is currently trading at $59,141. If the Bitcoin whales’ buying trend persists in March 2024, the BTC price rally will likely advance toward $70,000.

However, the historical accumulation trend shows that BTC faces stiff resistance around the $62,400 area.

IntoTheBlock’s in/out of the money data shows that 326,790 addresses had acquired 94,990 BTC at the maximum price of $62,424. Since those investors have been holding a loss since November 2021, many could exit as BTC’s price breaks even.

If the bulls can surmount that sell-wall, it could generate stronger bullish momentum for a new all-time high above $70,000 as predicted.

Alternatively, bears could seize control of the markets if they force a sharp downswing below $55,000. But currently, this seems a tall order considering the looming support buy-wall mounted at $57,360 territory.