Bitcoin’s safe-haven features could provide ‘solid support’ for spot ETFs, Kaiko says

As Bitcoin keeps outperforming traditional safe-haven assets like gold or bonds, providers of spot Bitcoin exchange-traded funds (ETFs) are likely to double down on their new products.

Bitcoin’s (BTC) asymmetric returns and low correlation could serve as “solid support” for the recently launched spot Bitcoin ETFs, given that institutional players are likely to continue fueling the ongoing enthusiasm for crypto ETFs.

In a research report, analysts at Kaiko noted that the largest cryptocurrency by market capitalization has accumulated over $2 billion in net inflow since spot ETFs launch on Jan. 10, signaling a growing investor appetite for Bitcoin as a safe-haven asset amid broader market uncertainties.

The 60-day correlation between BTC and the Nasdaq 100 index has seen a significant decline over the past year, Kaiko said, saying further that since June 2023, this correlation has been consistently close to zero.

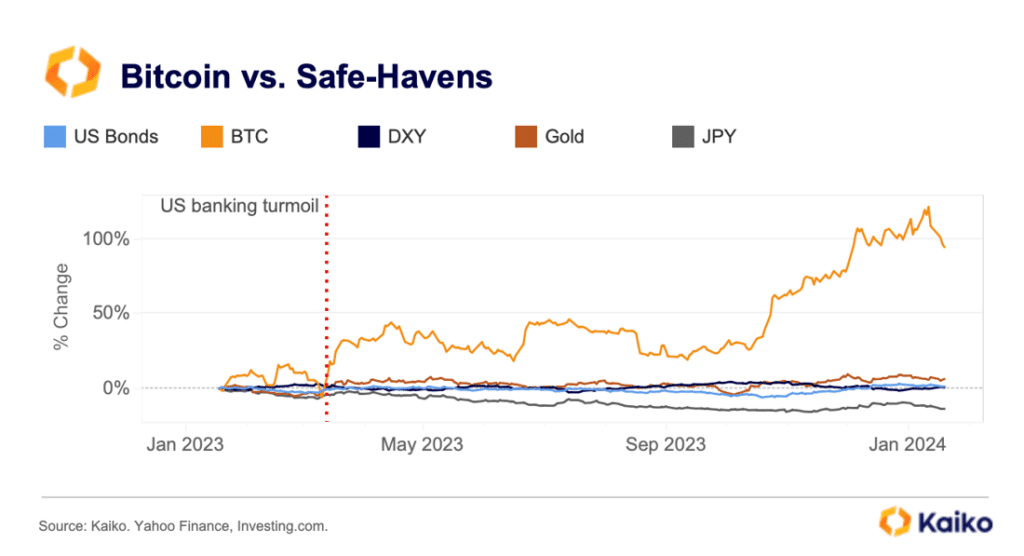

“Overall, however, BTC offers significantly higher returns than other traditional safe-havens such as gold, U.S. bonds or the dollar.”

Kaiko

While Bitcoin has solidified its status as a safe-haven asset by maintaining a low correlation with traditional markets, its appeal is further underscored by delivering substantially higher returns compared to assets like gold, U.S. bonds, or the dollar. Notably, Bitcoin exhibited exceptional performance during the U.S. banking crisis in 2023, attracting significant “safe-haven flows,” the Paris-headquartered firm added.

While gold prices rose 15% in 2023, reaching a record annual close at $2,078 per ounce, Bitcoin gained over 154%, contributing $530 billion to its market capitalization.

However, as of press time, BTC is grappling with surpassing the $40,000 threshold due to apparently consistent sales of Grayscale’s Bitcoin Trust (GBTC). As crypto.news reported earlier, Grayscale Investments sold over $2.14 billion in BTC following the approval of spot Bitcoin ETFs by the U.S. Securities and Exchange Commission.