Bitcoin Volatility Expectations Fall Sharply After BTC Price Failure to Break $25K

This time last week, Bitcoin looked like it might be on the verge of mustering a key short-term bullish breakout. The world’s largest cryptocurrency by market capitalization had formed a bullish short-term ascending triangle pattern and looked like it was about to break above the key $25,200-400 area, opening the door for a quick run higher towards the next major area of resistance around $28,000.

As things happened, a combination of macro headwinds (a month of strong US data and hawkish Fed speak that pushed US yields and the dollar higher and US stocks lower) and US regulatory concerns amid a widening crypto crackdown kept the bulls at bay. Bitcoin ended up falling about 3.0% last week and is already another just over 1.5% lower this week.

At current levels in the low $23,000s, Bitcoin is around the mid-point of February’s $21,400-$25,300ish range. And traders/investors seem to be betting that rangebound conditions will ensue for some time. At least, that’s the message that Bitcoin options markets are sending.

Bitcoin Volatility Expectations Drop After Failure to Break $25K

According to data presented by The Block, Deribit’s Bitcoin Volatility Index (DVOL) has dropped sharply over the course of the last week, seemingly as a direct result of Bitcoin’s latest failure to break above $25,000, which would have likely resulted in significant (most likely bullish) near-term volatility. The DVOL was last at 50, down from 60 this time last week. That’s not far above the record lows it printed back in January at 42, just before the 2023 crypto rally really got going.

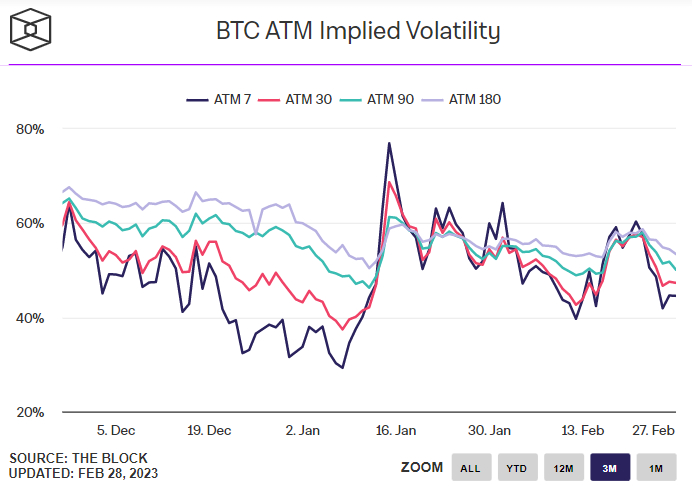

Separately, Implied Volatility according to the pricing of At-The-Money (ATM) options has also dropped sharply, with short-term volatility expectations experiencing the sharpest move lower. According to data presented by The Block, Bitcoin’s 7-day Implied Volatility was last at 44.55%, down from 60.33% this time last week. 30, 60 and 180-Day Implied Volatility are all also down sharply to 47%, 50% and 53.5% from 57%, 58% and 58% respectively this time last week.

Options Markets Mixed on the BTC Price Outlook

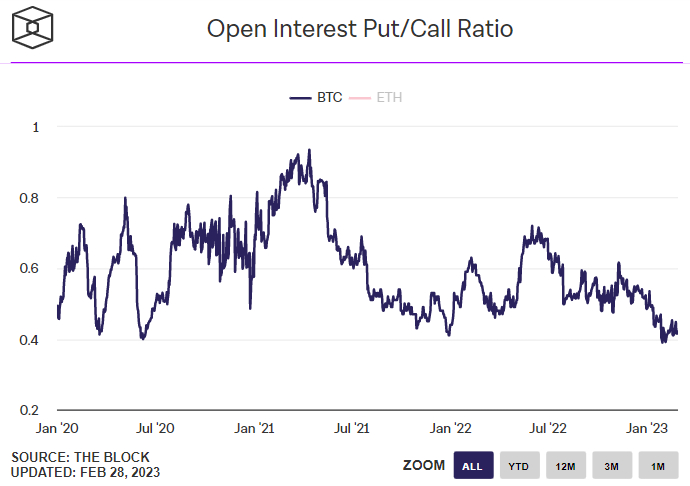

In terms of what options markets are saying about the outlook for Bitcoin, the picture is mixed. On the one hand, the ratio between open interest normally bearish Put and normally bullish Call options sits firmly in the favour of the latter group, and almost to a record degree. According to data presented by The Block, the Open Interest Put/Call Ratio was last 0.42, barely above the record lows it hit earlier this month at 0.39.

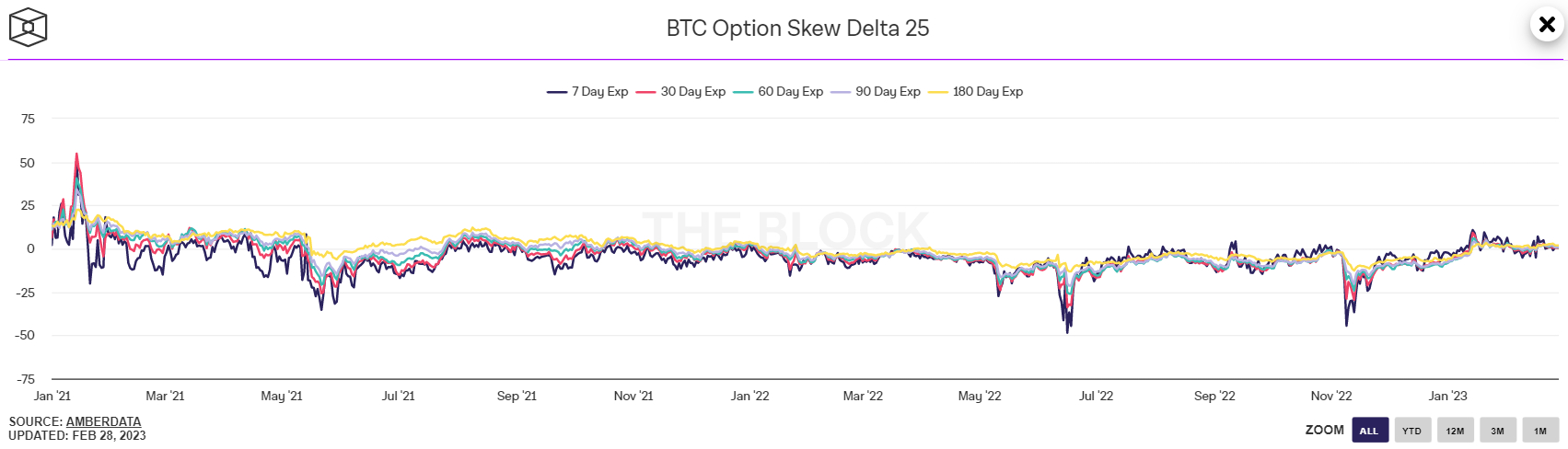

On the other hand, the Bitcoin 25% Delta Skew for options expiring in 7, 30, 60, 90 and 180 days is all close to zero, implying a neutral positioning bias. The 25% delta options skew is a popularly monitored proxy for the degree to which trading desks are over or undercharging for upside or downside protection via the put and call options they are selling to investors.

Put options give an investor the right but not the obligation to sell an asset at a predetermined price, while a call option gives an investor the right but not the obligation to buy an asset at a predetermined price. A 25% delta options skew above 0 suggests that desks are charging more for equivalent call options versus puts. This implies there is higher demand for calls versus puts, which can be interpreted as a bullish sign as investors are more eager to secure protection against (or bet on) a rise in prices.