Bitcoin Under Siege: Support Breakdown Raises Concerns Of Drop To $24,000

Bitcoin (BTC) is currently experiencing a tumultuous period, as highlighted by crypto trader and analyst Ali Martinez. With an astute eye for market trends, Martinez has taken to Twitter to share his belief that Bitcoin’s price is poised for further decline.

According to his analysis, Bitcoin seems to be succumbing to downward pressure from multiple key support levels, signaling a higher likelihood of a significant correction. Martinez suggests that the alpha coin may be on a trajectory toward an essential demand wall.

As the crypto community eagerly awaits the future direction of the top crypto, this anticipated downturn holds the potential to reshape the landscape of the cryptocurrency market.

Notice that #Bitcoin appears to be losing all major areas of support. This increases the probability of a correction to the next important demand wall between $23,200 and $24,000, where 850,000 addresses had previously purchased 340,000 $BTC. pic.twitter.com/IvBLJKiSVw

— Ali (@ali_charts) May 24, 2023

Bitcoin’s Support Levels Shaken: Potential For Major Correction

In the face of an evolving landscape of the cryptocurrency market, the leading cryptocurrency, Bitcoin, is facing a concerning situation as noted by Martinez’s tweet. It appears that BTC is currently experiencing a decline from all significant areas of support, heightening the chances of a substantial correction.

Investors and enthusiasts brace themselves as Bitcoin’s trajectory seems to be pointing towards a crucial demand wall situated between the $23,200 and $24,000 levels.

Source: IntoTheBlock

Within this crucial zone lies a remarkable transaction history, the analyst pointed out, where a staggering 852,000 investors acquired approximately 341,000 BTC, with an estimated value of $8,946,930,000. This accumulation of BTC at the demand wall indicates a substantial level of interest and potential support, making it a vital threshold to monitor for market participants.

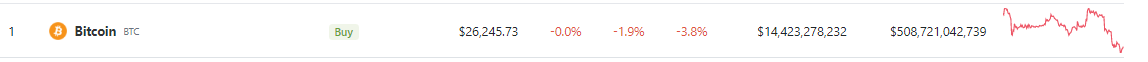

Bitcoin’s current price stands at $26,245, as reported by CoinGecko. However, recent developments have resulted in a nearly 2% slump within the past 24 hours alone. Zooming out to a broader perspective, the past week has witnessed a gradual decline of 3.8%, illustrating the volatile and ever-shifting nature of the digital asset market.

Source: Coingecko

BTC Dilemma: Waiting For A Resurgence Or Impending Fall

The current state of Bitcoin presents a dichotomy, with two contrasting viewpoints. Some view it as cautiously resting on a narrow ledge around the $27,000 mark, poised to resume its ascent. However, others see it as clinging on precariously, its grip slipping, and anticipate an inevitable decline to the mid-20s or potentially even lower.

BTCUSD weakens to the $26,253 level today. Chart: TradingView.com

Antoni Trenchev, co-founder and managing partner at crypto lender Nexo, expressed this sentiment in a Barron’s report, highlighting the two distinct perspectives surrounding Bitcoin’s future.

Adding to the growing apprehension is Bitcoin’s recent underperformance compared to traditional stock market indices. Despite factors such as the US debt ceiling crisis exerting more immediate influence on equities, Bitcoin has been lagging behind the Dow Jones Industrial Average and S&P 500 in recent days. This discrepancy raises concerns and presents a worrisome sign for market participants.

-Featured image from Crunchbase News