Bitcoin Price Prediction as Fed Chair Powell Warns of Higher Than Expected Interest Rates – Will Crypto Prices Crash?

In the world of cryptocurrency, Bitcoin remains one of the most popular and widely traded assets. Recently, as the Chairman of the US Federal Reserve, Jerome Powell, warned of higher-than-expected interest rates, many investors question whether this will lead to a crash in crypto prices.

In this update, we will take a closer look at the current state of the cryptocurrency market, analyze recent trends in Bitcoin prices, and predict what the future holds for the world’s most well-known digital asset.

Bitcoin Failed To Stop Its Losses & Remain in the Red Amid Powell’s Hawkish Stance & Uncertainties Surrounding Silvergate Bank

Bitcoin Price Prediction: Quick Fundamental Outlook

Bitcoin (BTC), the world’s largest cryptocurrency, has been unable to gain any positive traction and continues to flash red within the $22,000 range. The declines can be attributed to comments made by US Federal Reserve Chair Jerome Powell regarding interest rate hikes.

It is important to note that the cryptocurrency market has experienced a decline following Powell’s comments and the uncertainty surrounding Silvergate Bank.

This has led to a sense of uncertainty among traders and investors who are now trying to understand the potential impact of Powell’s comments on the market.

Apart from Powell’s comments, the uncertainty surrounding Silvergate Bank has also played a role in the decline of the cryptocurrency market.

The tension surrounding the bank has heightened the sense of uncertainty among investors, leading to a drop in cryptocurrency prices.

This has impacted other well-known cryptocurrencies, such as Ethereum (ETH), Dogecoin (DOGE), Ripple (XRP), and Solana (SOL), which have also experienced losses on the day.

Fed Chair Powell Warns of Higher Than Expected Interest Rates

Federal Reserve Chairman Jerome Powell concluded his second and final day of Congressional testimony with a relatively uneventful three-hour hearing in front of the House Financial Services Committee. Unlike Tuesday’s Senate Banking Committee hearing, the markets remained stable throughout the Q&A session, where stocks plummeted after Powell suggested the possibility of higher interest rate hikes to combat persistent inflation.

On Wednesday, Powell aimed to allay investor concerns by emphasizing that no decisions had been made regarding steeper rate hikes. He stated, “If — and I stress that no decision has been made on this — if the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.”

BTC Nears $20,000 Amid US Federal Reserve Pressure on Cryptocurrencies

Bitcoin (BTC) is currently at risk of falling below the $20,000 mark for the first time in two months due to the United States Federal Reserve’s hawkish stance.

The chairman of the US Federal Reserve, Jerome Powell, has stated that recent economic indicators have come in better than predicted, leading to the expectation that the ultimate level of interest rates will be higher than previously anticipated.

This has created market uncertainty and put pressure on cryptocurrencies, such as Bitcoin.

Powell’s remarks significantly impacted the US dollar, which jumped to a two-month high on the US Dollar Index (DXY) and subsequently contributed to the decrease in BTC prices.

It is important to note that the rising value of the US dollar has made Bitcoin and other cryptocurrencies more expensive for investors holding other currencies, leading to a decrease in demand.

This recent development highlights the volatility of the cryptocurrency market. It emphasizes the importance of keeping a close watch on geopolitical developments and economic data that may significantly impact the market.

Uncertainty Surrounding Silvergate Bank and its Impact on the Cryptocurrency Market

In addition to Powell’s remarks, the market’s downturn has been further exacerbated by the uncertainty surrounding Silvergate Bank. The bank is renowned for its strong support for cryptocurrency companies, but rumors suggest it has faced some regulatory issues.

This has caused traders and investors to worry about the bank’s future support for Bitcoin companies.

Bitcoin Price

The current Bitcoin price is $21,700, and the 24-hour trading volume is $22 billion. Bitcoin has fallen by over 1.50% in the previous 24 hours. Bitcoin is now the market leader, with a live market cap of $420 billion.

In technical analysis, Bitcoin currently has immediate support near the $21,550 level. A breakout of this level has the potential to trigger a bullish bounce-off.

On the upside, Bitcoin’s immediate resistance is at the $22,000 mark. A bullish breakout of this level could lead to a rise in BTC price towards the $22,500 or $22,850 level.

Conversely, a breakout of the $21,550 level could extend the selling trend until the $20,550 mark.

Buy BTC Now

Top Cryptocurrencies to Watch in 2023

You can visit Cryptonews’ Industry Talk team’s thoughtfully curated list of the top 15 altcoins to keep an eye on in 2023. This list is frequently updated with new ICO projects and altcoins, so be sure to check back often to stay current with the latest developments.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

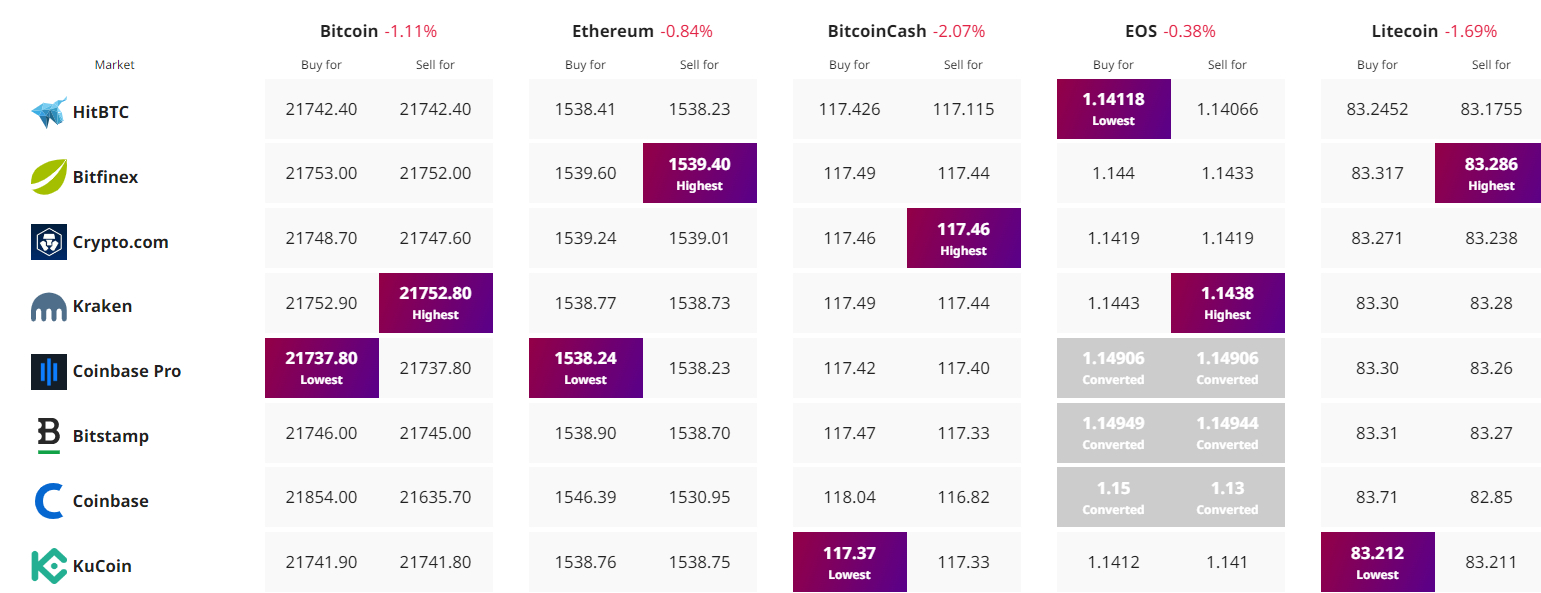

Find The Best Price to Buy/Sell Cryptocurrency