Bitcoin Indicator Shows Growing Divergence Between Whales And Retail – Details

Bitcoin is currently trading 7% below its all-time high of $112,000, facing increased selling pressure as the entire crypto market cools down. While some analysts believe further downside could follow, others point to shifting global dynamics that may soon favor Bitcoin. Rising US bond yields and persistent geopolitical tensions are reshaping risk sentiment across financial markets, potentially positioning BTC as a hedge in uncertain times.

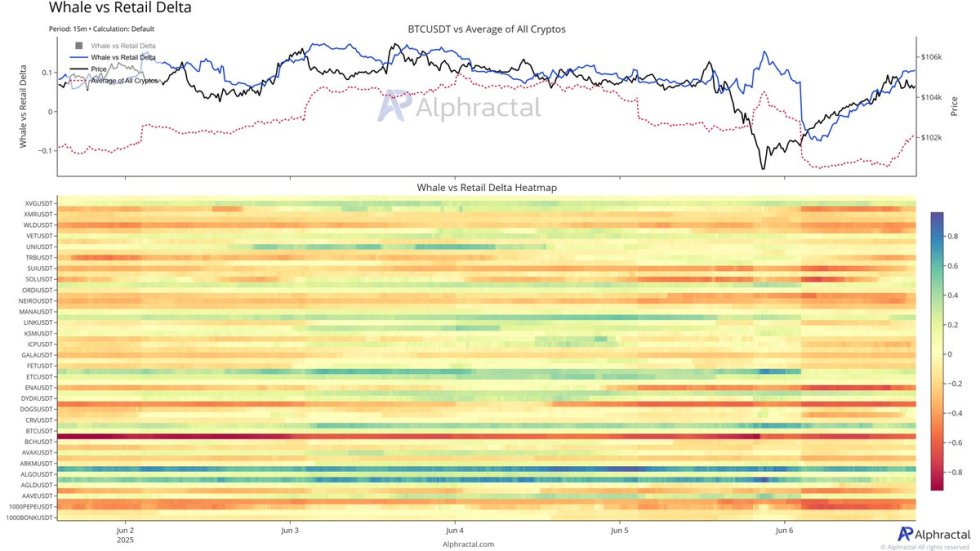

One key signal comes from whale activity. According to new data from Alphractal, the Whale vs. Retail Ratio has started rising again, suggesting large investors are taking on more risk while retail participants remain cautious. Historically, rising whale appetite has preceded major price rallies, as institutional players tend to act early during periods of uncertainty. This divergence between whales and retail traders may hint at an accumulation phase playing out beneath the surface, despite the current price pullback.

The coming days will be critical. If Bitcoin holds above key support levels, the presence of strong hands could support a reversal or consolidation before another attempt at price discovery. For now, whale conviction is rising — and that could prove pivotal if sentiment shifts bullish again.

Whale Activity Rises Amid Systemic Uncertainty

Bitcoin continues to trade above the crucial $100,000 level, even as global markets remain rattled by systemic risk, rising inflation, and deteriorating macroeconomic indicators. While equities and commodities reflect increasing volatility, Bitcoin appears to be entering a phase of resilience, often seen when investors search for alternatives in times of uncertainty.

Inflation remains persistent across developed economies, and bond yields continue to rise, placing pressure on traditional markets. Amid this backdrop, Bitcoin’s positioning as a hedge against monetary instability is gaining renewed attention. However, sentiment across the crypto market remains split, with many retail traders taking a cautious stance as volatility increases.

According to fresh data from Alphractal, a notable divergence is forming between whale and retail behavior. The Whale vs. Retail Ratio, which measures the positioning of large investors compared to smaller ones, has started to climb. This signals that whales are going long once again, while retail participants remain risk-averse.

Historically, spikes in this ratio have preceded major price rallies, as whales often accumulate ahead of broader market shifts. “Risk appetite is back,” Alphractal notes — a potentially bullish signal amid current bearish sentiment.

This quiet accumulation from large players could lay the foundation for a strong move if macro conditions align and BTC holds key support. As the market looks for direction, whale confidence could be the catalyst that tips the scale.

Bitcoin Consolidates Above Key Support Level

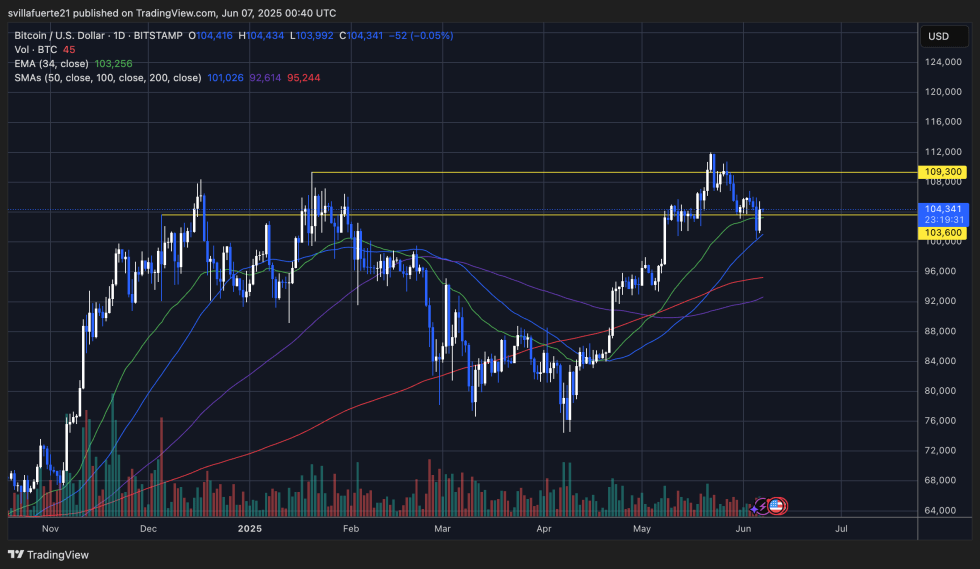

Bitcoin (BTC) continues to consolidate just above the crucial $103,600 support level, after briefly dipping below this line during recent market volatility. The daily chart shows BTC currently trading at $104,341, forming a potential higher low structure that could support a recovery if demand sustains.

Price action remains squeezed between the 34-day exponential moving average (EMA) at $103,256 and overhead resistance at $109,300, which marks the most recent local top. Holding above the 50-day simple moving average (SMA), currently at $101,026, is crucial for preserving the broader uptrend.

Volume has decreased slightly, suggesting a cooldown in momentum following the sharp 5% pullback earlier in the week. This low-volume environment could open the door for larger players to accumulate before another breakout attempt. The market is now waiting to see if bulls can push BTC back toward the $108,000-$109,000 resistance zone to test for a possible retake of the all-time high.

A breakdown below $103,600 would signal weakness and likely drive BTC toward the 100-day SMA near $92,600. For now, Bitcoin is holding strong, but any major macro developments or shifts in sentiment will determine whether the current consolidation becomes a launchpad or a reversal.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.