Bitcoin Breakout Or Breakdown? Ark Invest Shares Prediction

David Puell, an on-chain researcher at Ark Invest, today shared his insights in a detailed report, offering a nuanced perspective on Bitcoin’s current standing and future prospects. The report, titled “The Bitcoin Monthly: July 2023,” addresses several key topics that are central to understanding the current state of Bitcoin.

These topics include a comprehensive market summary, an analysis of Bitcoin’s low volatility and whether it indicates a potential breakdown or breakout, as well as a discussion on the impact of the Federal Reserve’s tightening policy as a leading indicator of price deflation.

Ark Invest’s Near-Term Bitcoin Price Prediction

Puell’s analysis reveals a mixed, but mainly bullish outlook for Bitcoin, with the cryptocurrency ending July at $29,230, above its 200-week moving average and its short-term-holder (STH) cost basis of $28,328. This suggests a strong support level for Bitcoin, indicating a potential upward trend, notes Puell.

However, Bitcoin’s 90-day volatility, which dropped to 36% in July, a level not seen since January 2017, presents a neutral outlook. Puell explains, “Based on its low level of volatility, we believe the Bitcoin price could be setting up to move dramatically in one direction or the other during the next few months.” This could mean a significant price movement, but the direction – up or down – is uncertain.

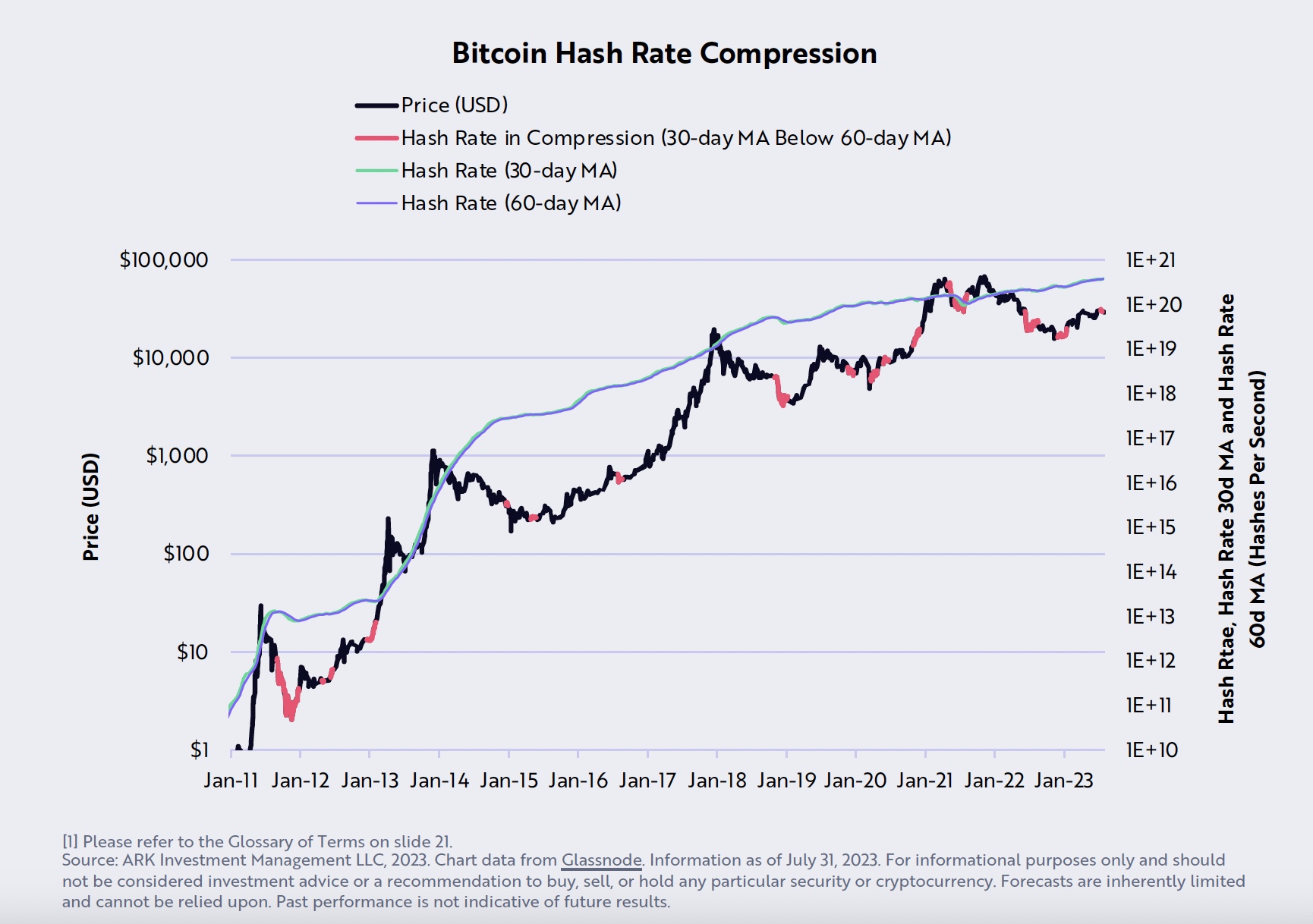

Puell also points to signs of miner capitulation as a bullish indicator. “During July, the 30-day moving average of Bitcoin’s hash rate dropped below its 60-day moving average, suggesting that miner activity had capitulated,” he states. Miner capitulation is typically associated with oversold conditions in BTC price, hinting at a potential bullish reversal.

The “liveliness” metric, which measures potential selling pressure relative to current holding behavior, also suggests a bullish trend. The analyst notes, “In July, liveliness dropped below 60%, suggesting the strongest long-term holding behavior since the last quarter of 2020.” This indicates that more holders are keeping their coins rather than selling them, which could drive the price up.

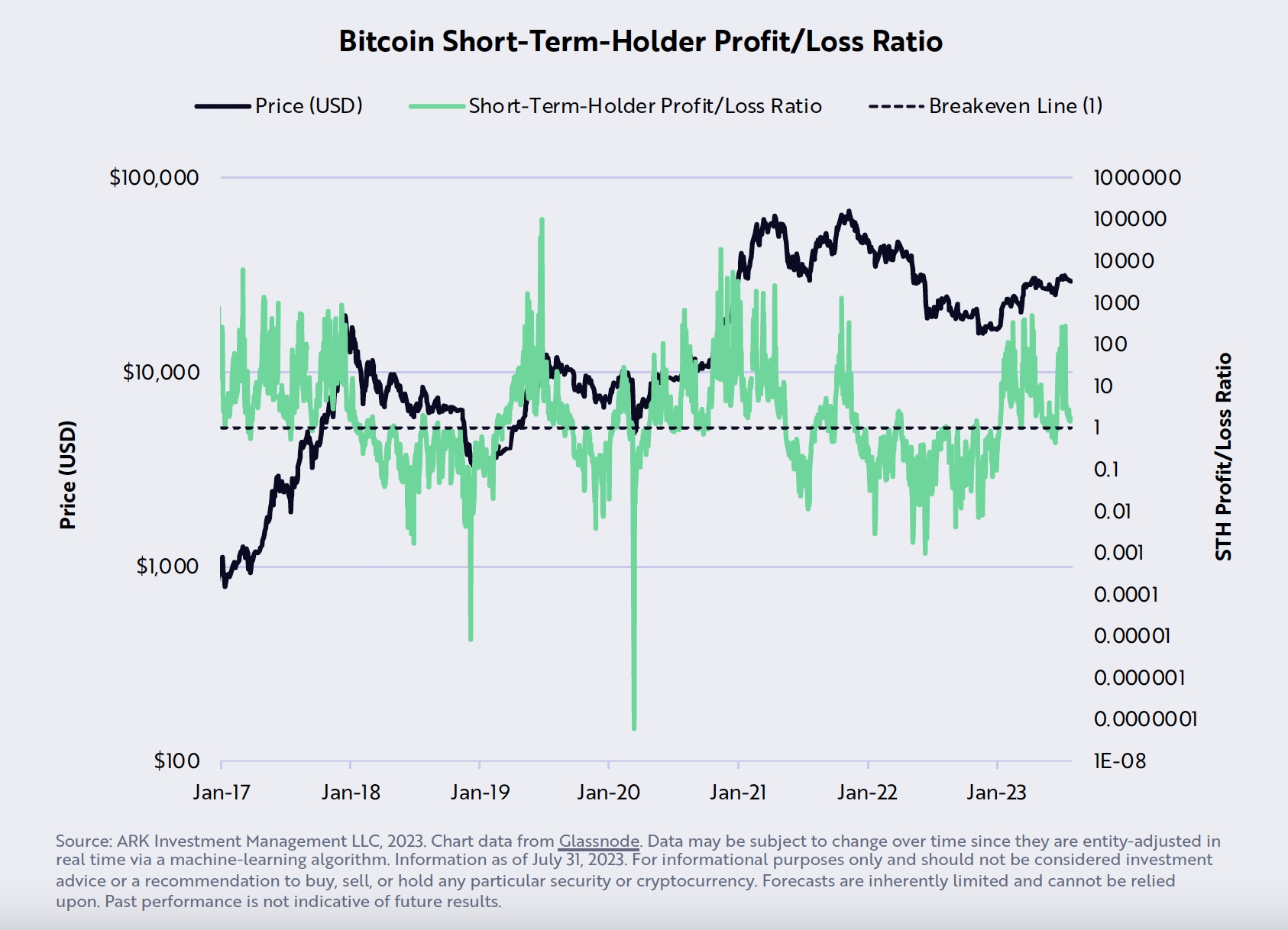

ARK’s own short-term-holder profit/loss ratio, which ended July at ~1, is also seen as a bullish sign. Puell explains, “This breakeven level correlates both with local bottoms during primary bull markets and with local tops during bear market environments.”

However, the future of Binance’s BNB token, which is facing increased regulatory pressure, looks bearish according to Puell. He warns, “As regulatory pressure increases on crypto exchange Binance, its native token, BNB, could be on the threshold of significant turbulence.” If BNB breaks down, it could potentially impact the overall stability of the crypto market, including BTC.

Macro Outlook

On the macroeconomic front, Puell discusses the potential impact of the Fed’s 22-fold increase in interest rates, which he views as bearish for Bitcoin and the broader economy. He states, “According to renowned economist Milton Friedman, monetary policy works with ‘long and variable lags’ that last 12-18 months, suggesting that the full impact of the Fed’s 22-fold increase in interest rates has yet to hit.”

The Zillow Rent Index, which leads the Owners’ Equivalent Rent (OER) by roughly nine months, suggests that Consumer Price Index (CPI) inflation could decelerate significantly below 2% by year-end. Puell views this as a bullish sign for Bitcoin, as it could potentially increase the attractiveness of non-inflationary assets like Bitcoin.

Lastly, Ark Invest takes a neutral stance on the falling US import prices from China, despite the yuan’s depreciation by ~12% since February 2022. He notes, “All else equal, China exporters should have increased prices to offset the depreciation of the yuan. Instead, they have cut prices, harming their profitability.”

In conclusion, Puell’s report presents a complex picture for Bitcoin. While there are a lot of signs for a potential bullish trend, there are also significant risks and uncertainties that could lead to bearish outcomes.

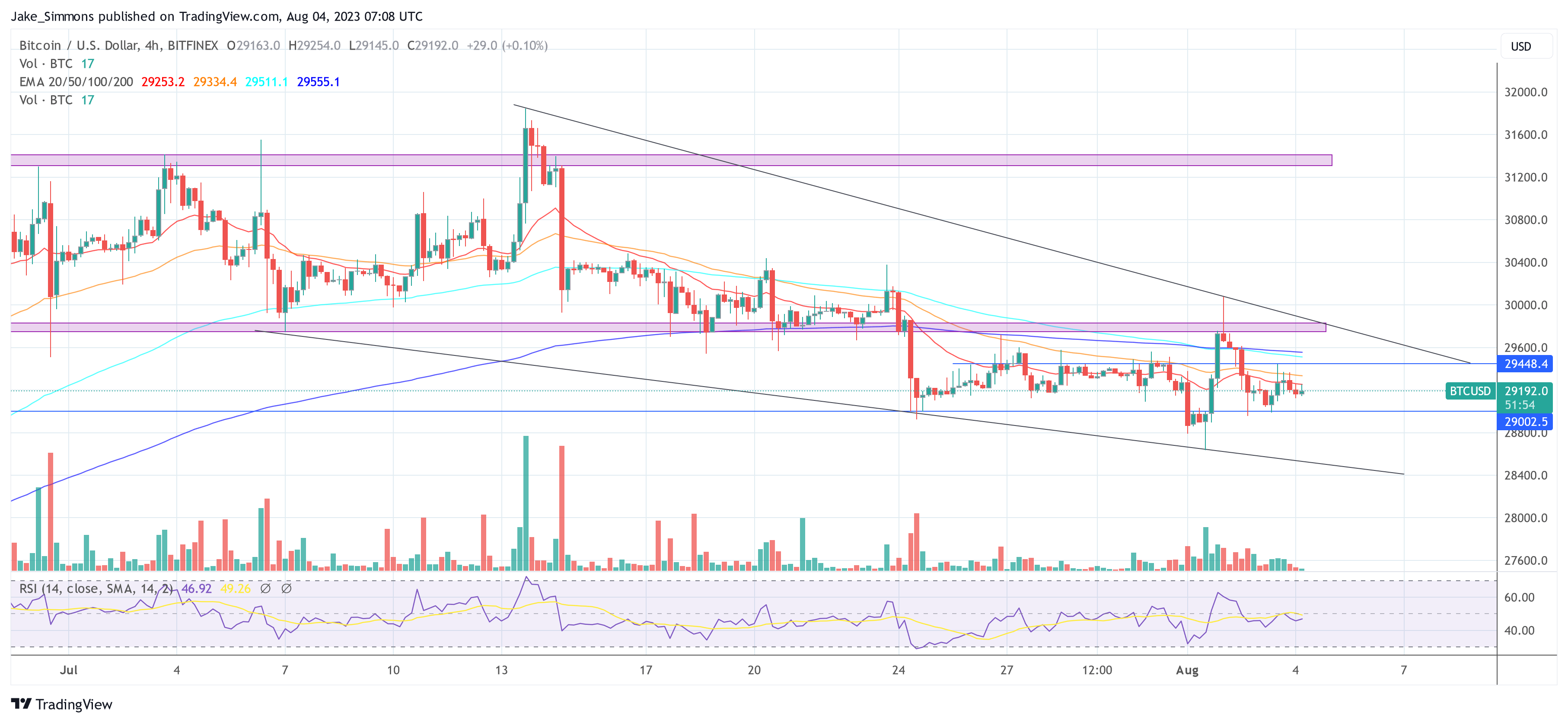

At press time, the BTC price was at $29.152. The most crucial resistance at the moment lies at $29.450. If BTC can overcome this resistance, a breakout from the multi-week downtrend might be possible.

Featured image from Kanchanara / Unsplash, chart from TradingView.com