Binance Former Leader Seeks Quick Exit from $1.8 Billion FTX Lawsuit

Former Binance CEO Changpeng “CZ” Zhao has moved to shake off a $1.76 billion clawback bid from the now-bankrupt FTX trust. It’s a bold opening move. Based on reports, he argues the case should never have landed in a Delaware court.

Challenge To Delaware Jurisdiction

According to a report, Zhao insists he lives in the United Arab Emirates and has no real ties to Delaware. He points out that the complaint doesn’t show he’s “at home” there.

His lawyers say the US Bankruptcy Court for the District of Delaware lacks power to decide this fight. If the judge agrees, FTX may have to find a new venue or refile elsewhere.

Those jurisdiction rules matter when you’re chasing a humongous amount of money like $1.76 billion. FTX says the money flowed from a share purchase deal in 2021.

Binance snapped up those shares just as FTX was heading toward insolvency. Zhao’s team calls that claim weak. They claim it falls outside US laws because the deal and his actions mostly took place overseas.

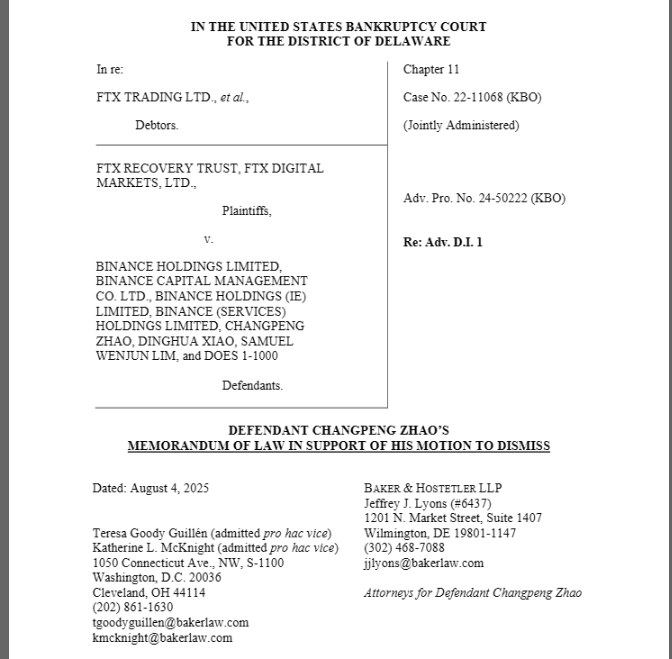

Zhao's motion to dismiss in the US Bankruptcy Court for the District of Delaware.

Fight Over Fraud Claims

Based on the motion filed on Monday, Zhao’s side also questions whether US fraud rules can stretch beyond America’s borders.

He argues that the regulations at issue don’t apply to someone living in the UAE. Reports have disclosed that he challenged what lawyers call “constructive fraud” counts.

Those counts hinge on federal definitions tied to securities contracts, Zhao’s filing says.

FTX first sued Binance and Zhao back in November 2024. At that time, a Binance spokesperson blasted the effort as “meritless.”

They said the trust was trying to shift blame for FTX’s collapse onto Binance and its founder.

Binance already filed a similar motion to dismiss in May. That earlier paper noted FTX blamed Binance for “pervasive malfeasance” by Sam Bankman-Fried.

Weighing The Prior Motions

That May motion raised many of the same points now front and center. It highlighted that FTX’s lawyers pointed to emails and wire transfers routed through US banks.

Binance replied that those links aren’t enough. They argued simple financial messages don’t create a business “presence” in Delaware.

Sam Bankman-Fried is serving a 25-year sentence for fraud and conspiracy. Whatever happens next, this fight over venue and jurisdiction will set the stage for a long legal battle over who pays for FTX’s losses.

Zhao himself served four months in prison after pleading guilty to US anti-money laundering charges.

The Pushback

Meanwhile, FTX trust attorneys are expected to push back. They’ll stress that billions of dollars moved through US accounts. They’ll say those wires and phone calls establish jurisdiction under longstanding rules.

The court’s decision on this procedural step could stretch on for months.

Featured image from Horacio Villalobos Corbis/Getty Images, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.