$1.2 Billion In ETH Exits Exchanges

On-chain data shows the Ethereum Exchange Netflow has remained negative during the past week, a sign that could be bullish for ETH.

Ethereum Exchange Netflow Suggests Trend Of Withdrawals

In a new post on X, the institutional DeFi solutions provider Sentora (formerly IntoTheBlock) has talked about the latest trend in the Exchange Netflow of Ethereum. The “Exchange Netflow” here refers to an on-chain metric that keeps track of the net amount of the cryptocurrency moving into or out of the wallets associated with centralized platforms.

When the value of this metric is positive, it means the investors are depositing a net number of tokens to these platforms. As one of the main reasons why holders transfer to exchanges is for selling-related purposes, this kind of trend can have a bearish impact on the ETH price.

On the other hand, the indicator being under zero suggests the outflows are outweighing the inflows. Generally, investors take their coins away from the custody of exchanges for holding into the long term, so this kind of trend can prove to be bullish for the asset.

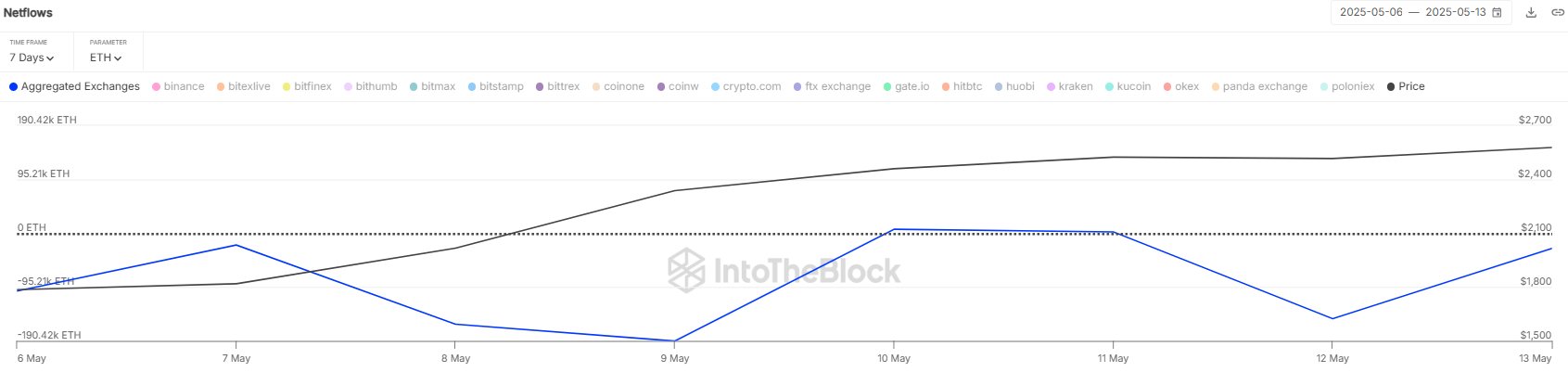

Now, here is the chart shared by the analytics firm that shows the trend in the Ethereum Exchange Netflow over the past week:

The value of the metric appears to have been negative in recent days | Source: Sentora on X

As displayed in the above graph, the Ethereum Exchange Netflow has mostly been negative inside this window, which implies the holders have been pulling supply out of the centralized exchanges.

In total, the investors have made withdrawals worth $1.2 billion with this outflow spree. “This sustained trend of net outflows, intensifying since early May, signals continued accumulation and reduced sell-side pressure,” notes Sentora.

While ETH has seen this bullish development recently, the cryptocurrency may not be offering that good an entry opportunity right now, as the analytics firm Santiment has explained in an Insight post.

The data for the 30-day and 365-day MVRV Ratios of ETH | Source: Santiment

The indicator shared by the analytics firm is the “Market Value to Realized Value (MVRV) Ratio,” which basically provides a measure of the profit-loss situation of the Bitcoin investors.

In the chart, Santiment has included two versions of the indicator: 30-day and 365-day. The former tells us about the profitability of the investors who purchased within the past 30 days and the latter that of the past year buyers.

As is visible in the graph, the 30-day MVRV Ratio for Ethereum has a notable positive value right now, implying the recent buyers are in significant profit. More specifically, the metric is sitting at 32.5%, which is well above the 15% danger zone for altcoins that the analytics firm recommends as a rule-of-thumb.

“It may not mean that prices are about to drop, but it does suggest that the rally will likely slow or halt until the 30-day MVRV dips back down to something more reasonable,” explains Santiment.

ETH Price

At the time of writing, Ethereum is trading around $2,600, up over 43% in the last week.

The trend in the ETH price over the last five days | Source: ETHUSDT on TradingView

Featured image from Dall-E, Santiment.net, IntoTheBlock.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.